Ether Holds Steady Above $2,500 as ETF Demand Signals Institutional Confidence

Ether

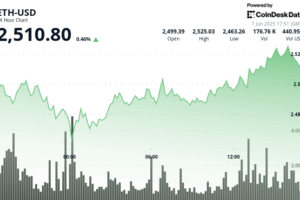

has rebounded firmly from key support near $2,460, recovering losses and stabilizing above the $2,500 threshold amid broader market volatility.

The rally follows a higher low formation backed by above-average volume, signaling growing market confidence.

Institutional participation appears to be reinforcing the trend, with BlackRock’s ETHA ETF reporting $492 million in net inflows last week.

Total holdings now exceed $4.84 billion, reinforcing long-term bullish sentiment even as price action remains sensitive to geopolitical developments.

Traders are watching to see if ETH can challenge resistance in the $2,520–$2,530 range.

Technical Analysis Highlights

- ETH traded within a $72 range over 24 hours, from a low of $2,460.35 to a high of $2,532.41.

- A key support zone formed at $2,460–$2,470, where ETH bounced on strong volume during midnight hours.

- Final hour surge reached $2,515.11, backed by 5,919 ETH in volume.

- Higher low structure established with interim support at $2,485 and resistance at $2,503.

- Final retracement held support at $2,507, with price consolidating around $2,510 into the close.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.