Bitcoin Steady Above $104K as Traders Eye Historically Bullish Second Half

Crypto markets drifted lower on Thursday, caught between hawkish macro guidance, looming küresel trade deadlines, and fading volatility. Bitcoin

hovered near $104,700 during Asia hours, slipping 1.2% over 24 hours, while ether

traded just below $2,860, down 1.8% on the day.

The soft price action tracks with broader macro unease following Wednesday’s FOMC hold, where the Fed kept rates unchanged but reiterated a cautious, inflation-sensitive stance.

Seasonality is starting to show

Historically subdued during the June-July stretch, crypto markets have entered a lull with BTC front-end implied volumes slipping under 40%, erasing the risk premium from recent geopolitical tension, Singapore-based QCP Capital noted in a Thursday market broadcast.

Open interest across BTC and ETH perps remains flat, and option markets skew negative, with puts trading at a premium to calls – a sign of traders hedging against short-term pullbacks.

“There’s been no change to the technical picture, which remains supportive of another push to the topside,” said Joel Kruger, strategist at LMAX Group, in an email to CoinDesk. “BTC continues to consolidate bullishly, and a move through recent highs could set up a run toward $145,000.”

Ether still lags its 2021 highs but is gaining momentum, he added. “Clearing $2,900 could bring $3,400 into play,” Kruger said.

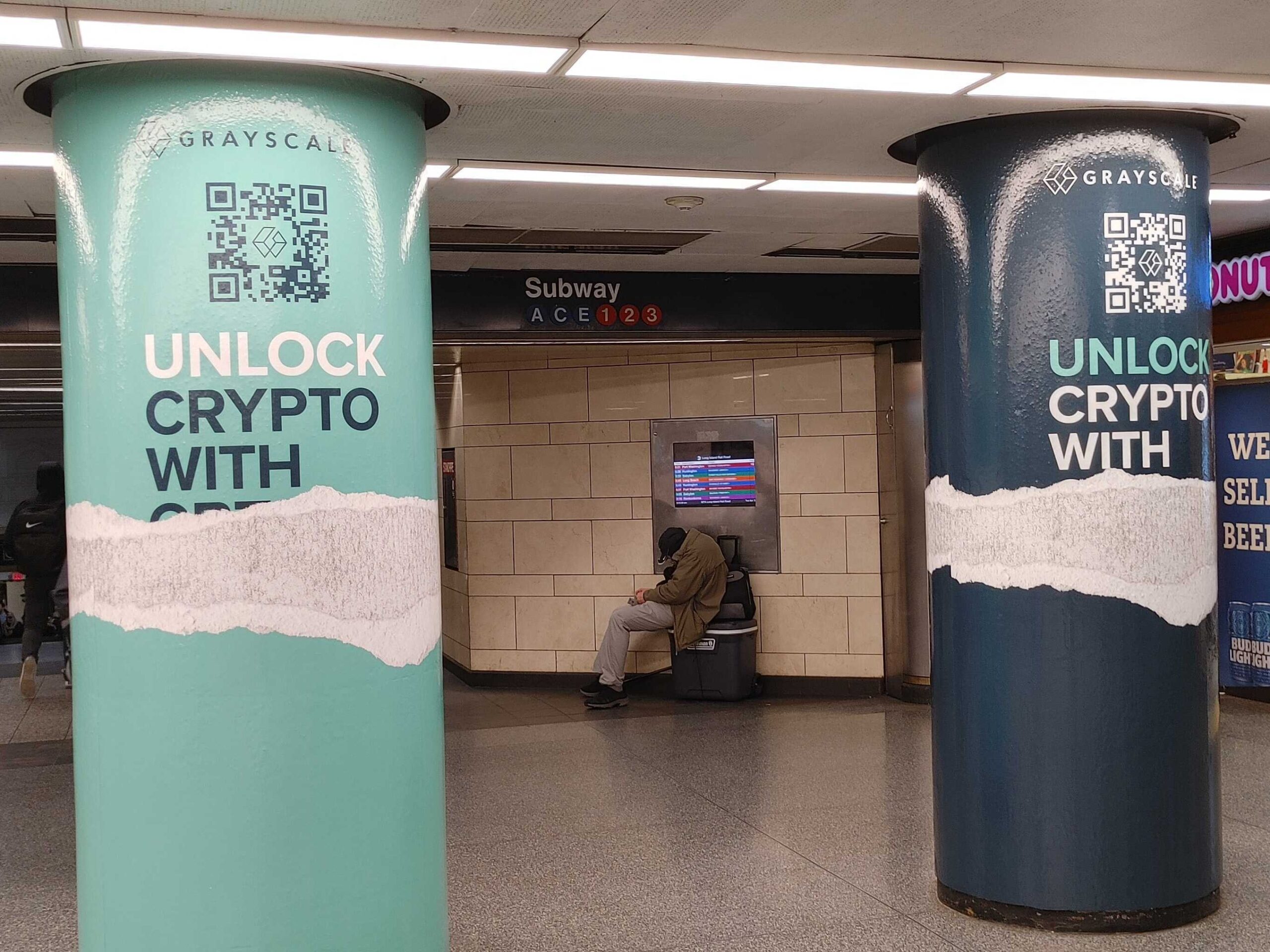

One bright spot for crypto is the U.S. Senate’s passage of a stablecoin framework, which adds another building block to what is becoming a more regulatory-friendly küresel environment. That’s reinforced a broader institutional conviction.

“Globally, we’re seeing continued progress that promises greater clarity and a more welcoming environment for institutional crypto adoption,” Kruger added.

Still, the near-term setup remains cautious. Month-end OPEX flows, systematic rebalancing, and a lack of fresh catalysts could keep BTC stuck in its $ 102,000–$ 108,000 band for now.

But with H2 historically strong for crypto, some desks are already looking ahead. “The worst may be behind us,” Kruger said. “And the next leg up could catch many off guard.”