Coinbase Sets U.S. Perpetual-Style Futures Launch as CEO Says Firm Is Buying Bitcoin Weekly

Crypto exchange Coinbase (COIN) will start offering perpetual-style futures contracts in the U.S. on July 21, becoming one of the first regulated players to offer the globally popular product.

The new vehicle, first available with bitcoin

and ether

, will trade on the Coinbase Derivatives Exchange, a CFTC-regulated venue.

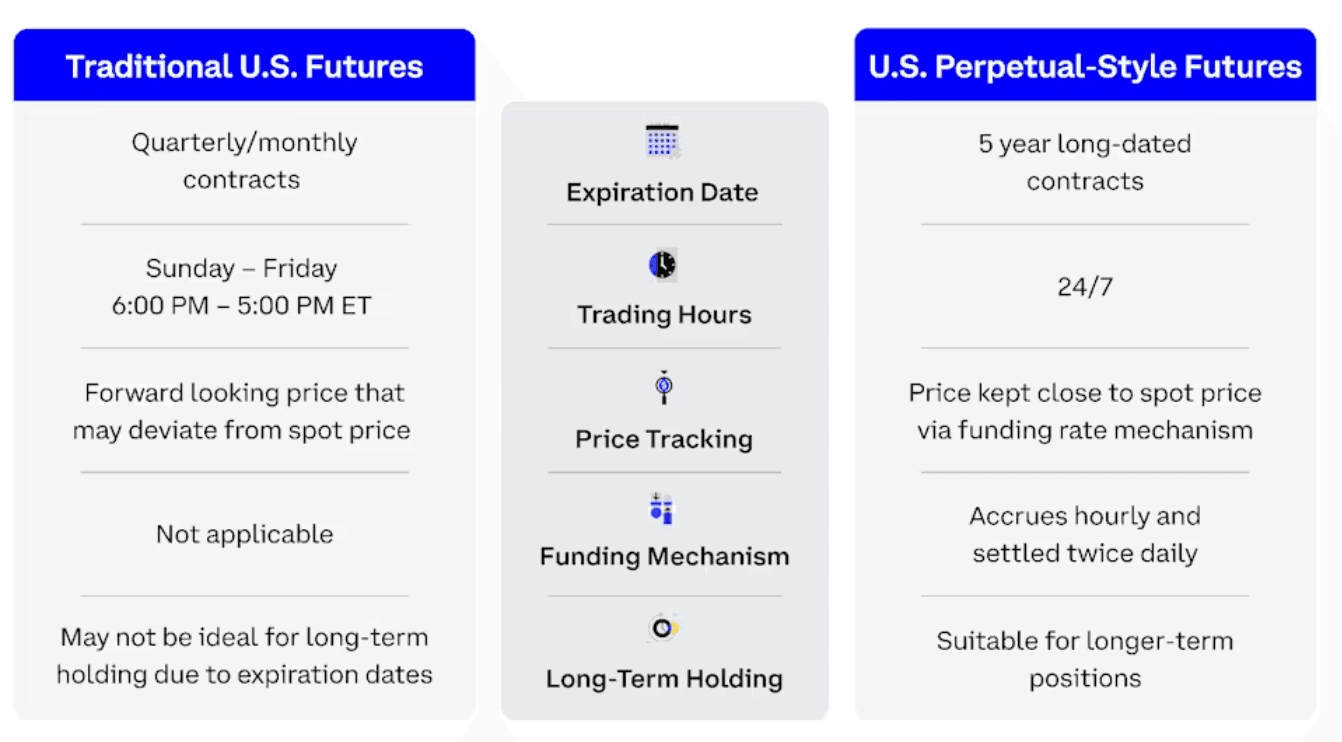

Unlike offshore perpetuals, which dominate küresel crypto derivatives markets but are not approved in the U.S., Coinbase’s instruments are structured as long-dated futures with five-year expirations. They incorporate a funding rate mechanism that accrues hourly and is settled twice daily to mimic the price dynamics of perpetual swaps. Trading will be available 24/7 and settlements will be handled through regulated clearing.

Separately, Coinbase CEO Brian Armstrong said the company also accumulates bitcoin on a regular basis as an investment.

“We’re buying more bitcoin every week. Long Bitcoin,” Armstrong said in a Thursday X post in response to David Bailey, CEO of the bitcoin treasury firm Nakamoto Holdings.

This comes after Coinbase CFO Alesia Haas revealed in the first quarter 2025 earnings call that the firm purchased $150 million in crypto, predominantly bitcoin. Coinbase holds 9,257 BTC worth nearly $1 billion on its corporate balance sheet and is one of the top 10 publicly-listed holders of the asset, according to the latest veri compiled by BitcoinTreasuries.net.