Stablecoins Are the ‘Quiet Winners’ of Polymarket’s Surge: Coinbase Research

As Polymarket seeks a $1 billion valuation in a Founders Fund-led round, the “quiet winners” may be the stablecoins underpinning its settlement infrastructure, Coinbase analysts wrote in a Friday research report.

All of the platform’s trades settle in Circle’s USDC on Polygon, creating measurable demand for the dollar-pegged token. And while lending protocols lock capital in pools, prediction markets like Polymarket cycle funds at a high velocity — settling, redeploying and transferring balances continuously, the analysts said.

The platform has processed more than $14 billion in lifetime trading volume. In May alone, it cleared $1 billion, with daily active traders averaging between 20,000 and 30,000.

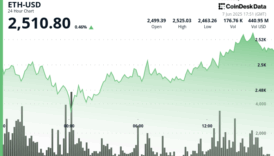

Meanwhile, in the immediate aftermath of U.S. President Donald Trump’s re-election in November 2024, monthly volume soared to $2.5 billion, sparking corresponding spikes in USDC transfers and bridge activity.

Such flows demonstrate how stablecoins now power real-time market infrastructure. “Momentum is likely to accelerate further with a new content partnership with X, positioning prediction markets as viral social content rather than purely financial tools,” the report said.