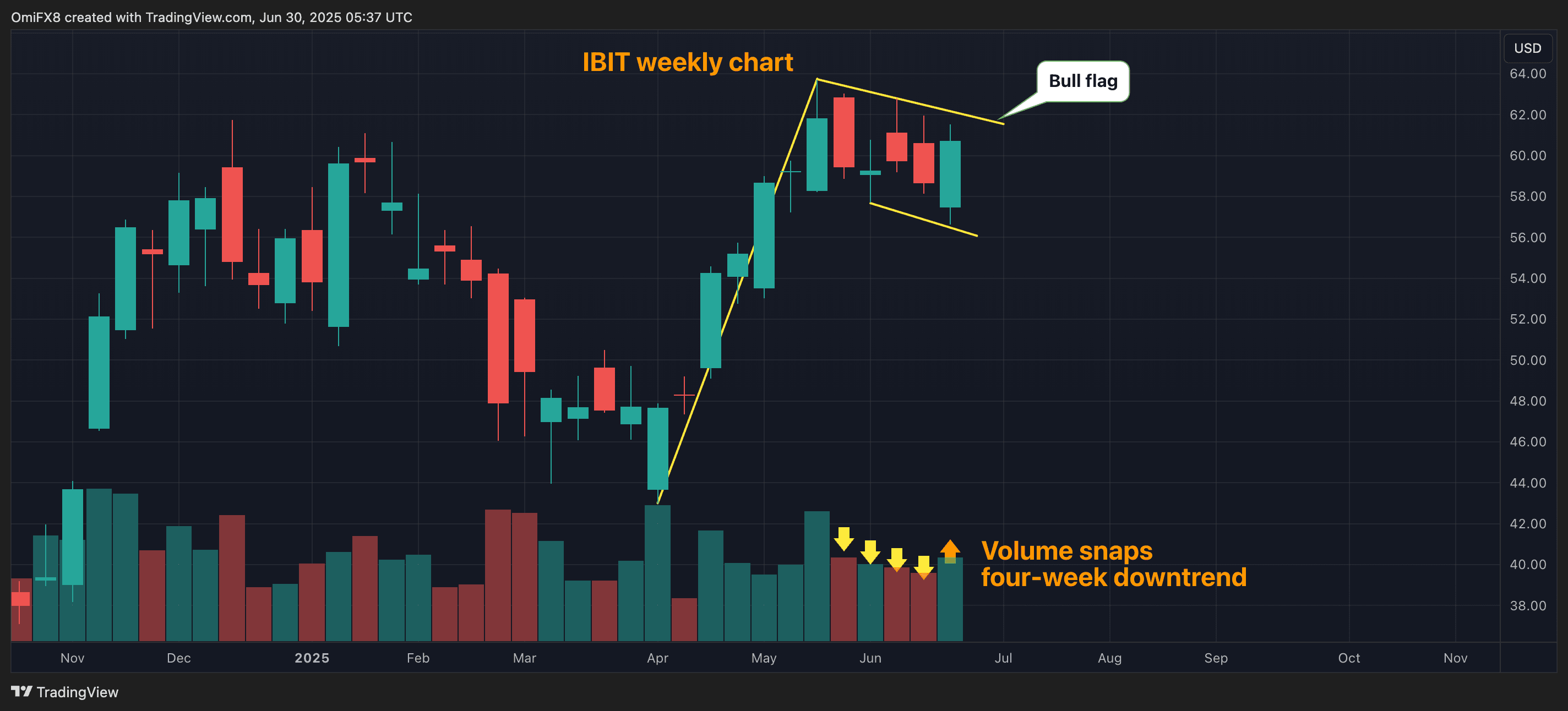

BlackRock’s Spot Bitcoin ETF Snaps Four-Week Downtrend in Volumes

BlackRock’s spot bitcoin

exchange-traded fund (ETF) listed on Nasdaq under the ticker IBIT rose 3.49% last week, snapping a four-week downtrend in trading volumes.

A total of 210.02 million shares changed hands in the week ended June 27, registering a 22.2% growth from the preceding week’s volume tally of 171.74 million shares, according to veri source TradingView. That’s the first weekly growth since the third week of May.

The renewed upswing in volume comes amid continued demand for the ETF. Last week, IBIT registered a net inflow of $1.31 billion, following the preceding week’s tally of $1.23 billion. The largest publicly listed fund has amassed $3.74 billion in investor money this month, according to veri source SoSoValue.

The 11 spot ETFs listed in the U.S. have collectively registered a net inflow of over $4 billion this month, marking the third consecutive monthly inflow.

The chart shows that IBIT has formed a bull flag, mimicking the bullish continuation pattern on the spot BTC price chart.

A breakout, if confirmed, would signal an extension of the bull run from early April lows near $42.98.