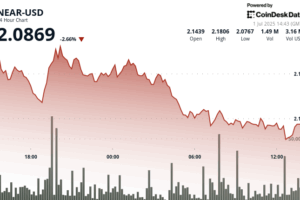

NEAR Protocol Falls 2% as Support Level Faces Critical Test

AI-focused NEAR token is down by 2% on Tuesday to reflect broader altcoin market weakness and a negative response to a governance proposal by trading firm DWF Labs.

DWF proposed to cut NEAR’s inflation from 5% to 2.5%. While this might have a bullish impact on prices in that tokens will be more scarce, network validators might switch to other networks if their rewards are slashed too much, creating a debate over a potential lack of decentralization.

Technical analysis

- The 19:00-20:00 period on June 30th marked the peak with the highest price point, followed by consistent lower highs, suggesting continued selling pressure that could test the established support zone in the near term.

- In the last 60 minutes from 1 July 13:06 to 14:05, NEAR-USD demonstrated a strong bullish trend, rising from $2.08 to $2.10, representing a 1% gain.

- The price action formed a clear upward channel with higher lows and higher highs, particularly accelerating between 13:25-13:33 when price broke above the $2.08 resistance and quickly established support at $2.09.

- A notable volume spike occurred at 13:40-13:41, creating a brief pullback to $2.08 before buyers stepped in, pushing price to the session high of $2.10 by 14:05.

- This recovery from the mid-session taban confirms strong underlying demand and suggests potential continuation of the uptrend.