Circle’s USDC Hits Record Market Cap Over $56B as Stablecoin Demand Soars

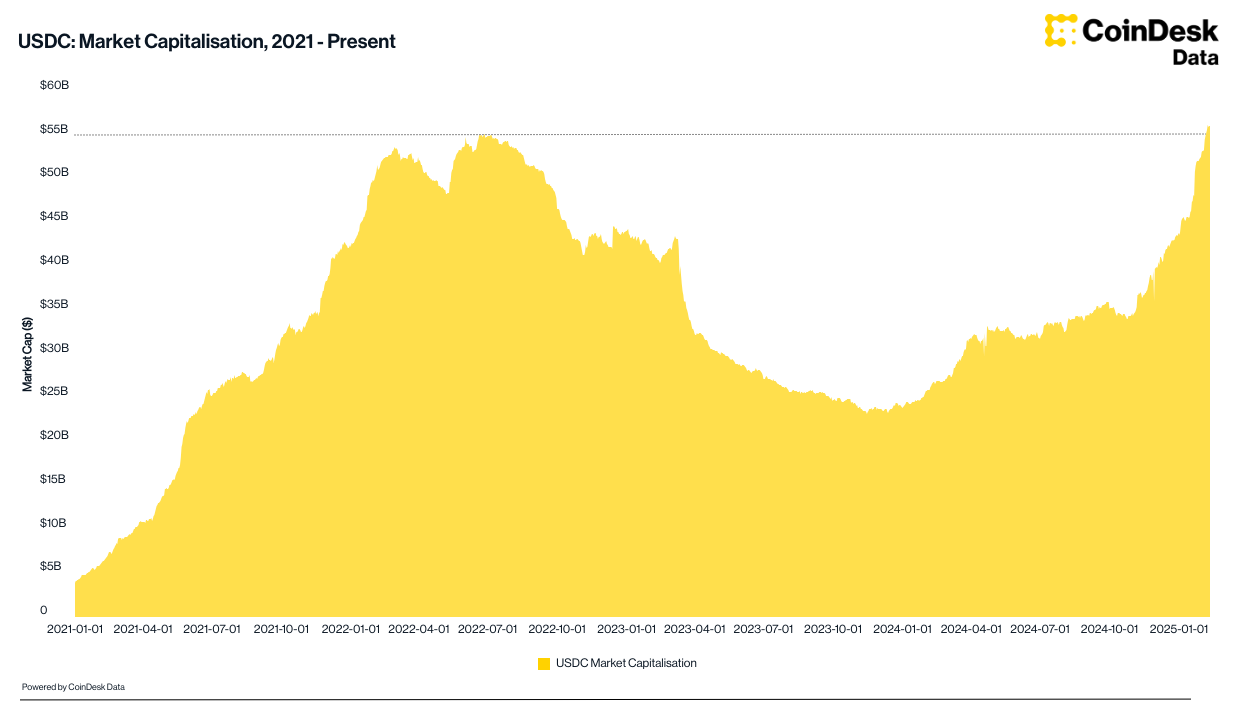

Circle’s USDC, the second-largest stablecoin on the market, rose to a record market capitalization over $56 billion this week as stablecoin growth showed signs of reaccelerating.

USDC added $10.2 billion to its market cap over the past month, driven primarily by rising Solana-based DeFi trading volumes, Artemis veri shows. That’s more than double the $4.6 billion growth of Tether’s USDT, the largest stablecoin in the market and Circle’s biggest competitor, during the same period. USDT still dominates the stablecoin space with a $142 billion market cap.

With the latest growth spurt, USDC surpassed its 2022 peak and fully recovered from the 2023 U.S. regional-banking crisis, which dealt a serious blow to the cryptocurrency. At the time, Circle held a part of stablecoin reserves in bank deposits at Silicon Valley Bank, which suffered a bank run and led to USDC temporarily losing its peg to the U.S. dollar. Many token holders fled to USDT, helping Tether to surpass its 2022 peak market capitalization as early as May 2023.

Stablecoins are a special type of cryptocurrencies with prices anchored to an external asset, predominantly to the U.S. dollar. USDT and USDC are widely used for trading on crypto exchanges and serve as a key source of liquidity. Thus, their expanding supply is a key indicator of investor demand and overall health of crypto markets.

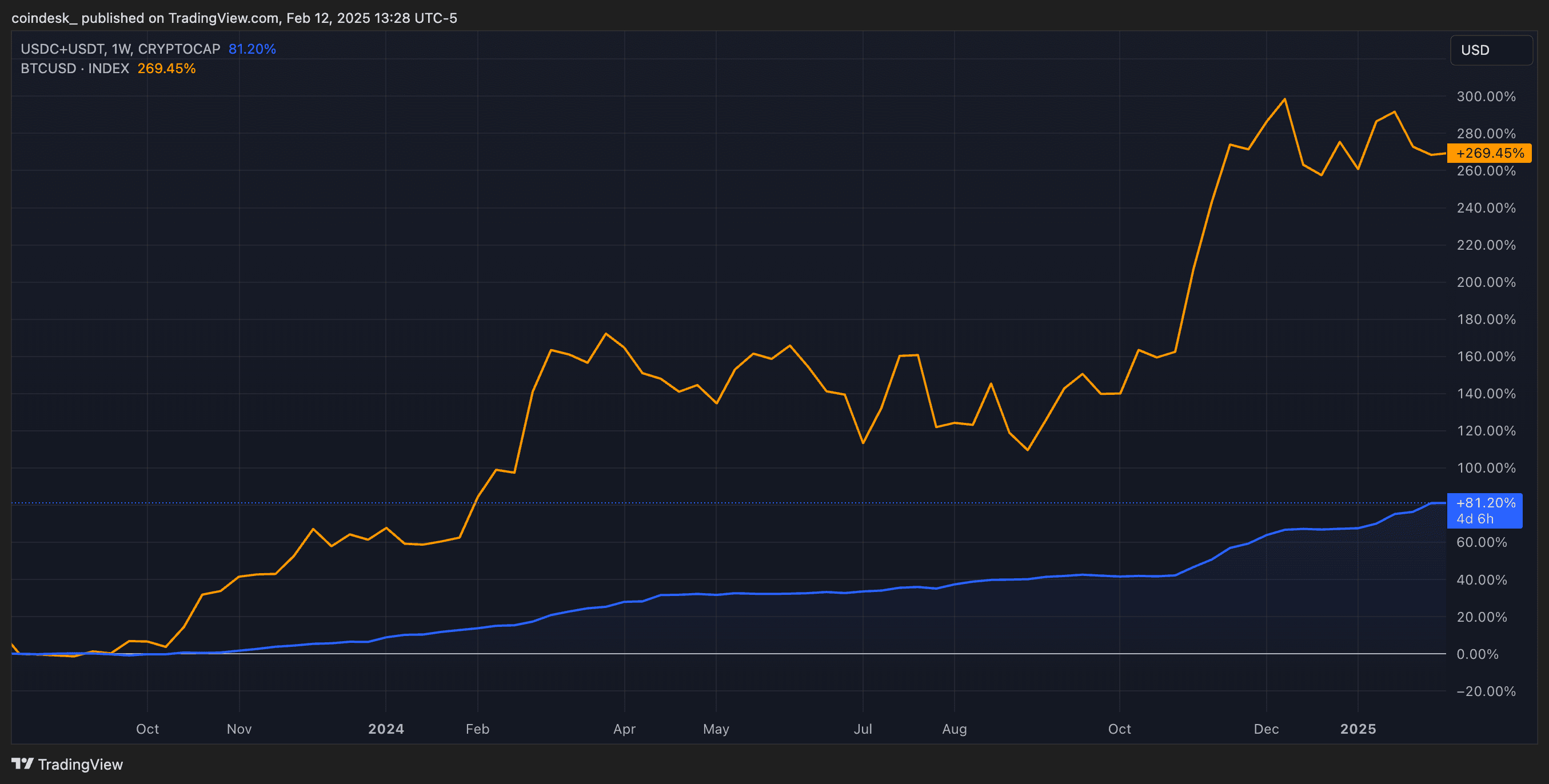

After a period of tepid action in December and early January, USDT and USDC growth accelerated in the past weeks, veri shows. Previous growth spurts, such as between late October and early December and October 2023 to April 2024, coincided with steep rallies in bitcoin (BTC) and altcoin prices.

Accelerating stablecoin growth, while it’s only one of the factors influencing crypto markets, offers a positive signal for the overall market health amid macro headwinds and consolidating prices.