U.S. Senators Push for SEC to Rethink Crypto Staking in Exchange Funds

Staking should potentially be added to the menu for crypto exchange-traded funds (ETFs), a bipartisan group of U.S. senators argued in a letter to the Securities and Exchange Commission (SEC) on Thursday.

Issuers of crypto ETFs had originally planned to include the staking feature in their fund offerings, but the SEC, under its past leadership, had balked at the idea. The agency, run by Chair Gary Gensler until the administration of President Donald Trump arrived last month, had previously pursued enforcement actions against firms such as Kraken, arguing staking amounted to an unregistered securities offering.

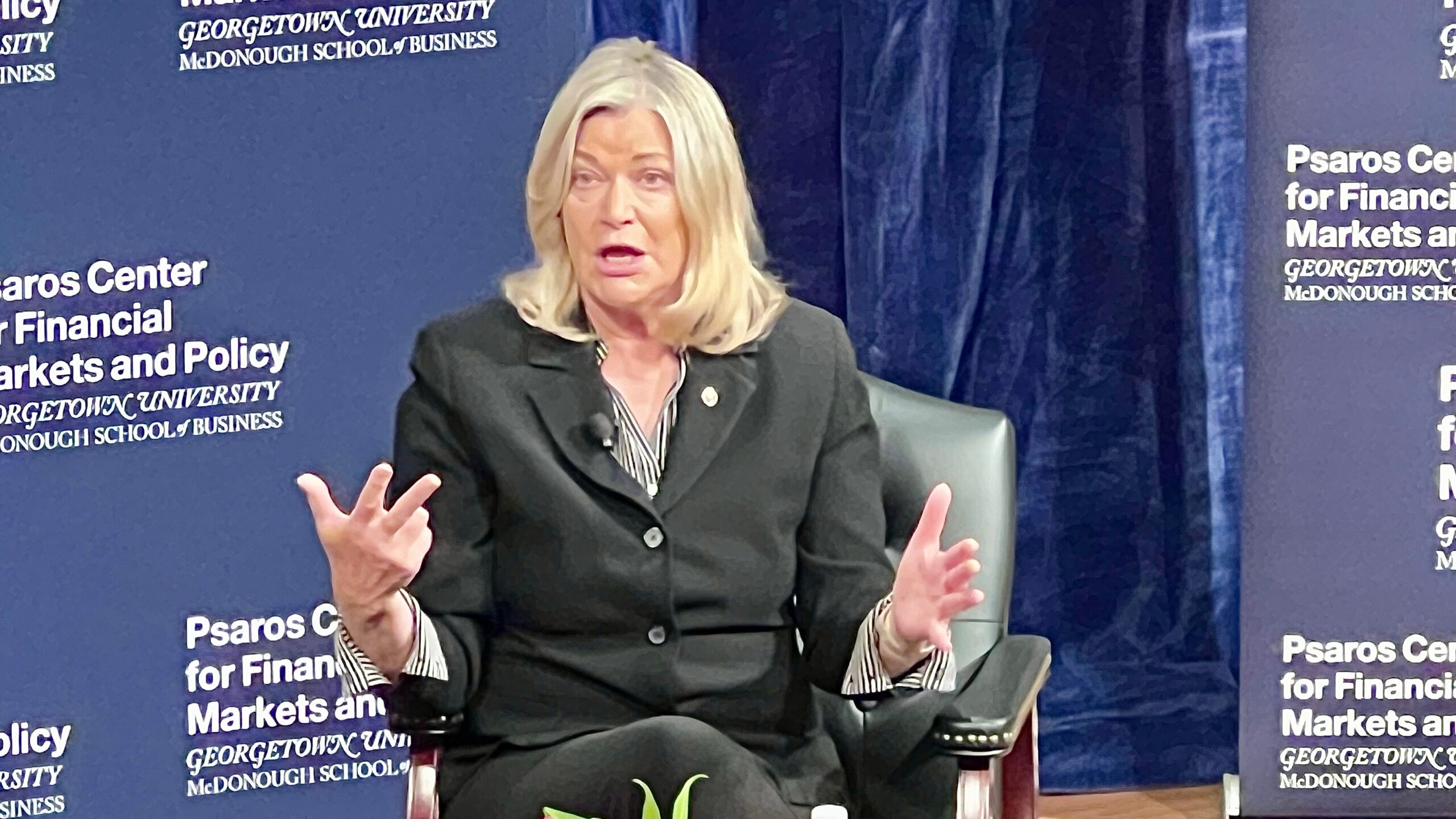

The senators’ letter — backed by Cynthia Lummis, the Republican chair of a Senate subcommittee that focuses on digital assets — calls for reconsidering the practice, which involves locking up digital tokens to support blockchain operations in return for rewards. Protocol staking is key to the security of ecosystems such as Ethereum, supporters contend.

“We encourage the SEC to consider the potential benefit to investors from allowing protocol staking in certain digital asset [exchange-traded products],” the letter to SEC Acting Chairman Mark Uyeda argued.

Other Republicans joined Lummis in the correspondence, and so did two Democrats: her usual crypto partner, Kirsten Gillibrand of New York, and also Ron Wyden of Oregon.