Bitcoin Chart Shows Back to Back Weekly Hammer Candles, Seen Only a Handful Of Times in BTC

The past few weeks have been highly volatile for bitcoin (BTC), with price action reflecting sharp swings. In the past two weeks bitcoin traded on an open-high, lower-close candlestick pattern with double-digit percentage differences.

The week beginning Feb. 24 saw bitcoin drop to a low of $78,167 and climb to a high of $96,515, a 23% swing. The following week, starting Mar. 3, recorded a low of $81,444 and a high of $94,415, marking a 16% swing.

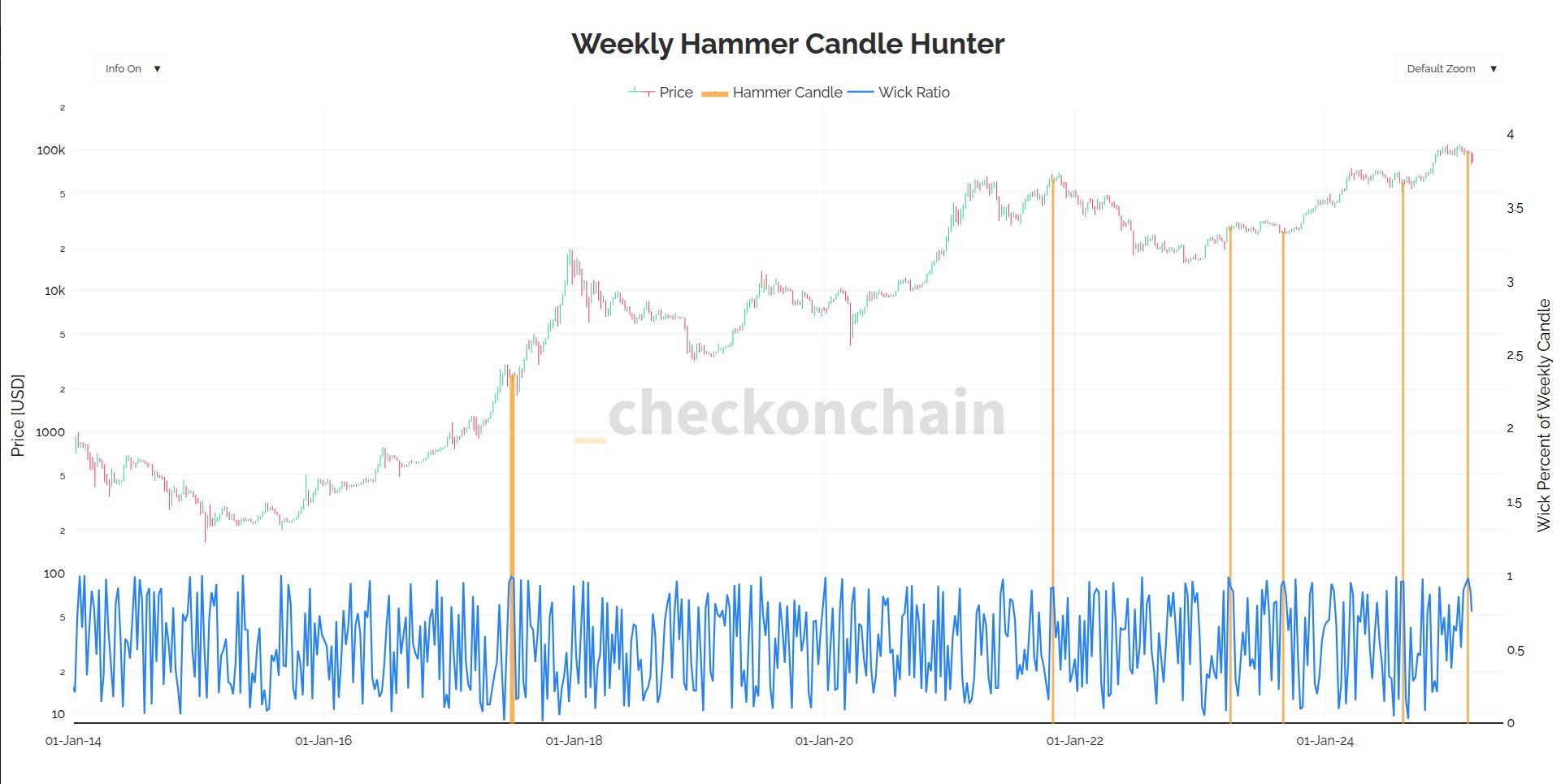

These large candlestick formations are known as hammer candles, as defined by analyst Checkmate, where the lower or upper wick makes up 90% of the total price range, leaving a small body with a long wick.

Checkmate’s analysis shows that Bitcoin has formed a weekly hammer candle with a 90% lower wick only five times in its history. These instances occurred during the 2017 bull run, the late 2021 bull market peak near $69,000, twice in 2023—following the Silicon Valley Bank crisis and again after the summer downturn—and evvel in 2024, also during a summer lull.

While the veri does not show a clear pattern in bitcoin’s cycle, the 2017 bull market correction stands out, suggesting that such formations could signal critical turning points in price trends.