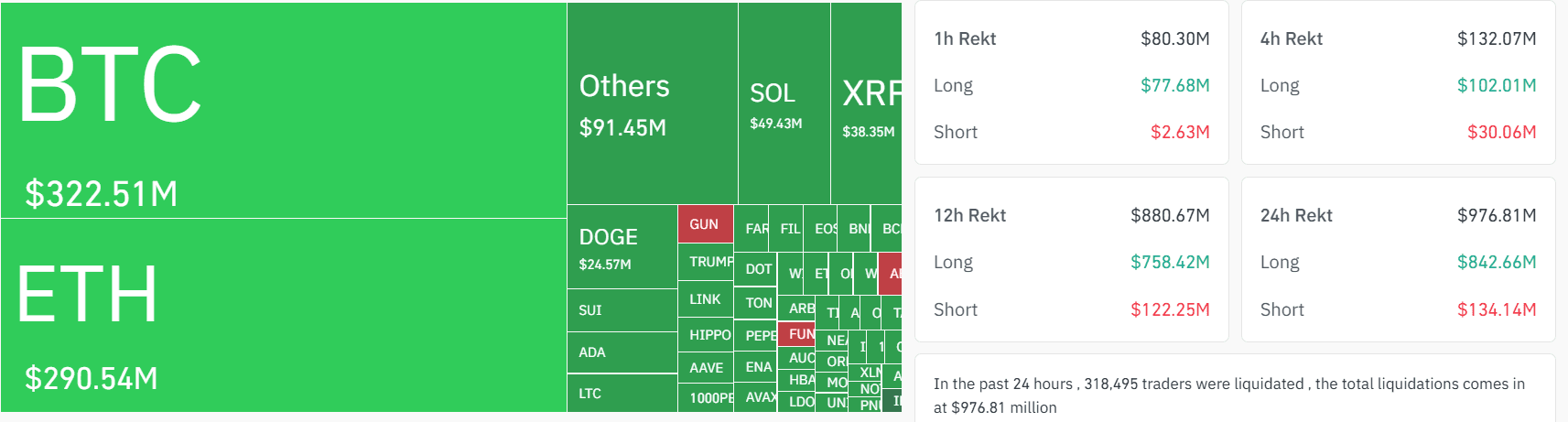

XRP, SOL Nosedive 14% as Crypto Bulls Rack $800M Liquidations

Futures tied to major tokens saw over $840 million in long liquidations in the past 24 hours as a bitcoin (BTC) plunge led to losses among major tokens, with some falling nearly 14%.

CoinGlass veri shows that bitcoin traders betting on higher prices lost over $322 million, while bets on ether (ETH) lost nearly $290 million. Smaller alternative tokens (altcoins) recorded nearly $400 million in liquidations — with futures tracking xrp (XRP) and Solana’s SOL seeing an unusually high $80 million in cumulative liquidations.

BTC slid to under $77,000 in its worst start to a historically bullish month late Tuesday, with ether (ETH) down 15% to $1,500.

SOL, XRP and dogecoin (DOGE) slid as much as 15%, before slightly recovering in Asian morning hours, with BNB Chain’s bnb holding relatively stronger with a 6% slide. The nosedive in majors was reflected across midcaps and smaller tokens — all showing drops of over 10-20% as per CoinGecko.

Data shows that nearly 86% of all futures bets were bullish. Traders were positioning for higher prices in the weeks ahead on expectations that current ongoings were likely priced in and that markets could see near-term relief.

A liquidation occurs when an exchange forcefully closes a trader’s leveraged position due to the trader’s inability to meet the margin requirements.

Large-scale liquidations can indicate market extremes, like panic selling or buying. A cascade of liquidations might suggest a market turning point, where a price reversal could be imminent due to an overreaction in market sentiment.

Global equities and risk assets such as bitcoin took a hit Monday as investors continue to remain fearful of the fallout from the Trump tariffs, sending U.S. stock index futures lower by about 5% as trading resumed after the weekend.

Hedge fund billionaire Bill Ackman urged the president not to go through with economic “nuclear war” and instead call a “time out” on Monday.