Bitcoin, Strategy Confirm Concurrent Bull Cross, Strengthening Uptrend Signal: Technical Analysis

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Imagine two major newspapers both endorsing the same presidential candidate. The joint support indicates that the candidate probably has a broad backing.

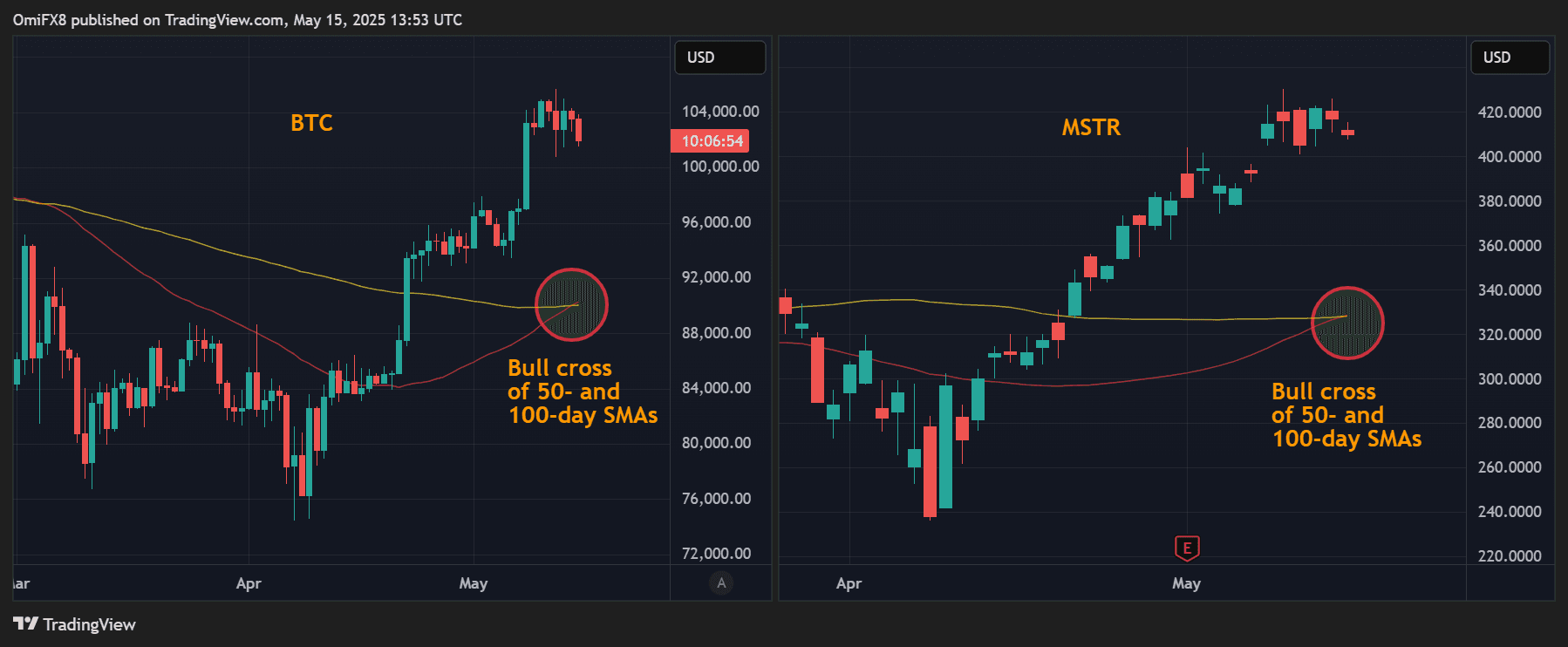

Similarly, when price charts for both bitcoin BTC$102,165.38 and Strategy (MSTR) — the largest publicly-listed BTC holder — show concurrent bullish signals, it’s likely a strong sign that the market and major institutional players are aligned.

Daily price charts for both BTC and MSTR show their 50-day simple moving averages (SMA) crossing above their 100-day SMA to confirm a so-called bullish crossover. It’s a sign the short-term trend is now outperforming the longer-term trend, which could be a signal of the beginning of a major bull market.

BTC’s bull cross is consistent with other indicators like the MACD, suggesting the path of least resistance is on the higher side.

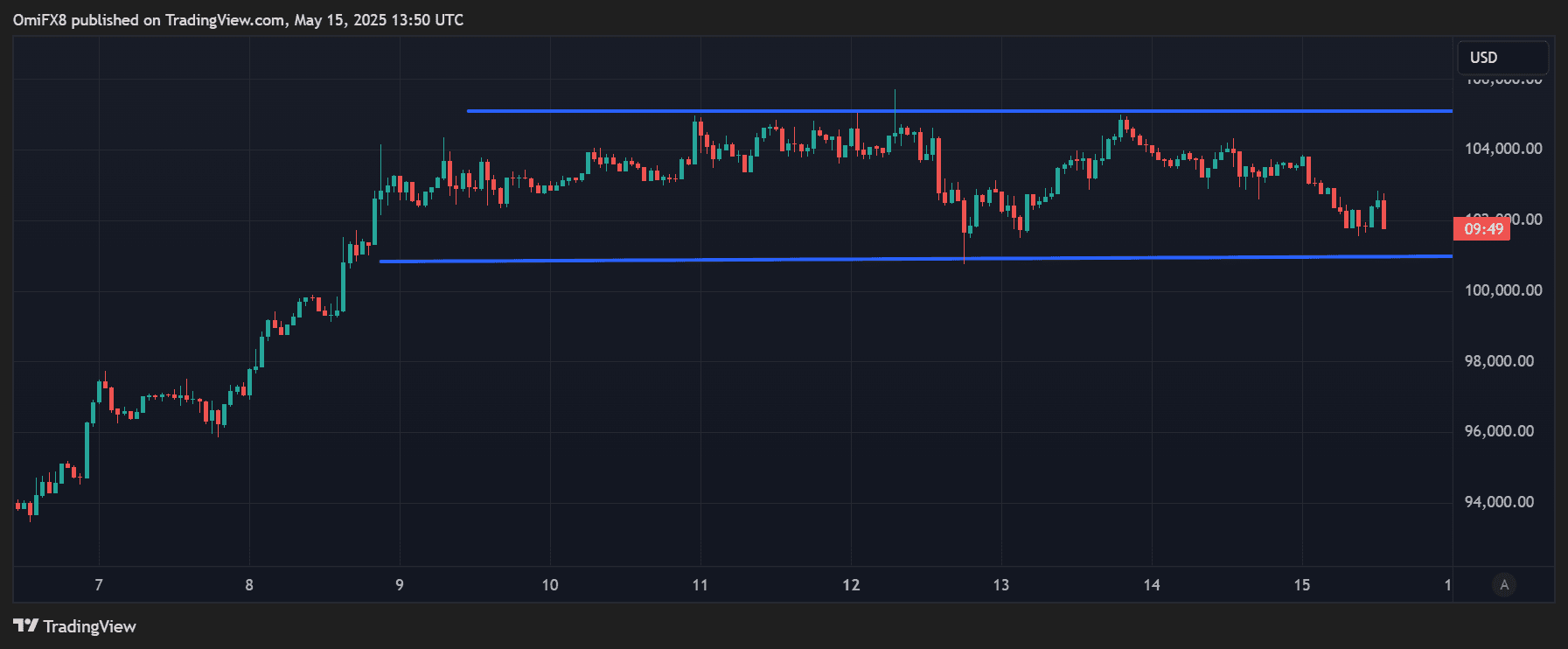

That said, an interim drop below $100,000 cannot be ruled out, as on-chain veri show influential market participants have turned cautious.

The chart shows BTC’s price rally has stalled in the $101,000-$107,000 range. A downside break could trigger more profit-taking, potentially deepening the bull market pullback to support at $98,000.