ADA Rockets 60%, XRP Up 25% on Trump’s Reserve Plans, But Traders Aren’t Fully Bullish Yet

U.S. President Donald Trump’s intentions of establishing a national strategic reserve of solana (SOL), cardano (ADA) and XRP sent the assets rocketing as much as 60% on Sunday. Still, traders express caution until plans are more concrete.

“The current upward momentum might see a correction in the short term, as investors price in the crypto reserve announcement and determine the meşru viability for Trump to create the reserve,” Kevin Guo, director of HashKey Research, told CoinDesk in a Telegram message Monday. “Federal Reserve Chairman Jerome Powell previously stated that the US central bank is not allowed to hold a reserve of Bitcoin, so there are still technical hurdles in front of Trump’s plans.”

“The President’s crypto summit may follow up with more details or other possible announcements that can further the crypto market’s recovery from recent lows,” Guo added.

Trump is scheduled to hold the first Crypto Summit at the White House on Mar.7, where he is expected to share further plans on how crypto regulations and businesses will be supported in the country.

Trump announced on Truth Social late Sunday that XRP, SOL and ADA would be included in a U.S. strategic crypto reserve. He later added Bitcoin and Ethereum to the list of assets composing the reserve, and has been discussing the idea of a strategic crypto reserve since his 2024 presidential campaign.

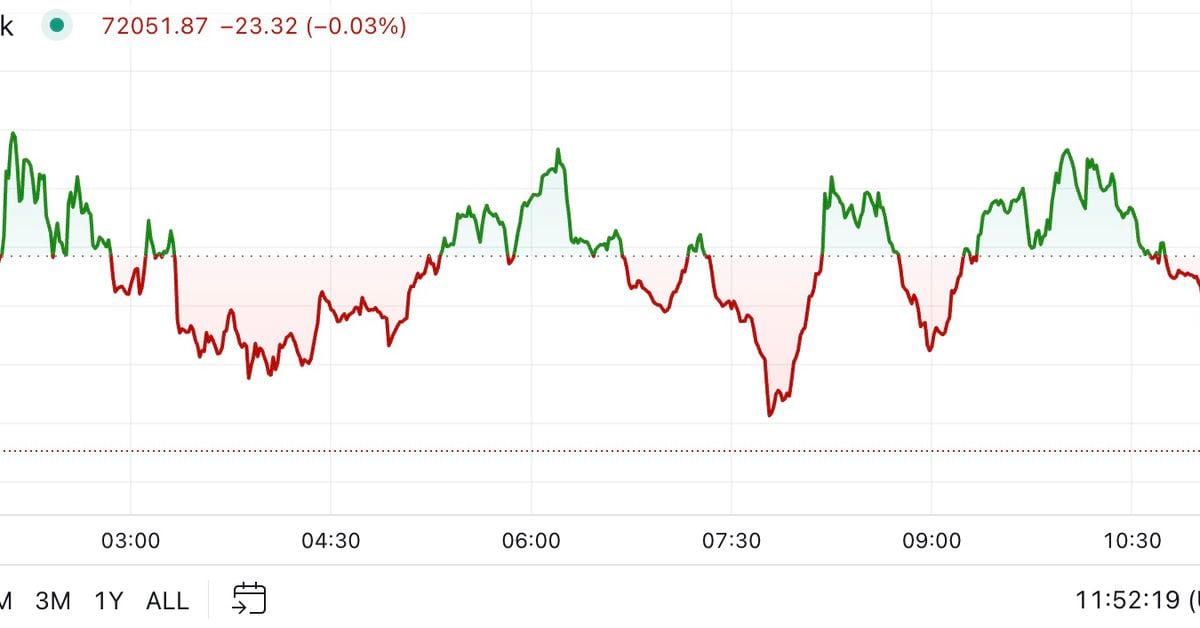

That sent markets higher almost instantly, with bitcoin up 6.5% to over $93,000 on Monday and the broader market tracked by the broad-based CoinDesk 20 (CD20) up 7%.

Elsewhere, tokens Chainlink’s LINK, Uniswap’s UNI and Movement’s MOVE are up 8% in the past 24 hours — mainly on their closeness to the Trump-family backed World Liberty Financial.

Still, some said there’s more work ahead before the current rally can be considered sustained.

“We expect more volatility until further details can solidify the creation of the strategy reserve, but the crypto market sentiment has swiftly changed, signaling a potential continuation of the bull market,” Chris Yu, CEO of SignalPlus, told CoinDesk in a Telegram message.

Yu anticipates investors will keep an eye on inflows to U.S.-traded ETF products after they registered record outflows last week, where an increase could give cues on signs of a bottom and the possible continuation of the bull market.