Bitcoin Price Drop Leads to $250M Bullish Liquidations; Crypto Sentiment Indicator Signals Top

Bitcoin (BTC) price fell nearly 4% in the past 24 hours amid continual profit-taking ahead of the weekend, causing a wider market retreat that led to over $250 million in bullish bets liquidated.

BTC fell from $72,500 early Thursday to just over $69,000 early Friday, paring down gains made by the token since Monday. Other major cryptos fell in tandem, with overall market capitalization falling 5.5%.

Meanwhile, the widely-watched Fear and Greed Index, a sentiment and volatility tracker for the crypto market, flashed “extreme greed” levels on Thursday, historically a sign of local tops.

The index aims to measure emotional responses in the crypto market, highlighting that extreme fear might present buying opportunities, while extreme greed could signal an upcoming market correction. The index is flashing “greed” as of Asian afternoon hours Friday – suggesting prices could correct further.

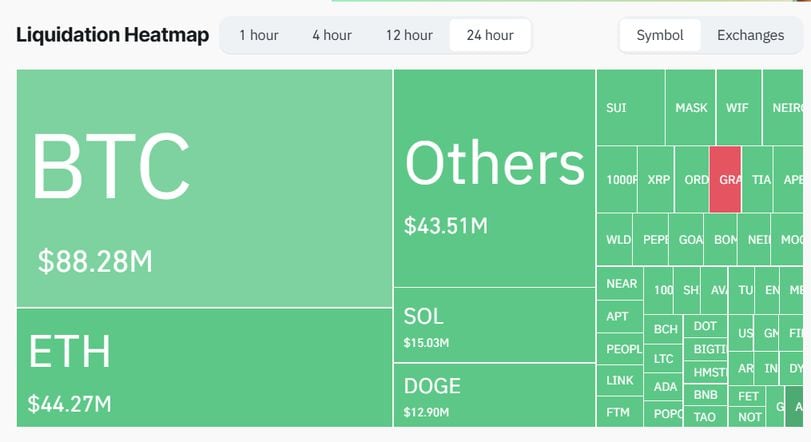

The price caused pain for futures traders. Bets on BTC-tracked futures recorded $88 million in losses, CoinGlass veri shows, followed by $44 million in liquidations on ether (ETH) futures and nearly $15 million in losses each on SOL and DOGE futures.

Nearly 90% of all futures bets were bullish, or expecting higher prices over the weekend ahead of the U.S. elections on November 5. Market conditions in the past few weeks, including küresel monetary policies and U.S. political support, indicated a continued bullish trend, with some traders targeting $80,000 for BTC in the coming weeks.

A liquidation occurs when an exchange forcefully closes a trader’s leveraged position due to the trader’s inability to meet the margin requirements. Large-scale liquidations can indicate market extremes, like panic selling or buying.

A cascade of liquidations might suggest a market turning point, where a price reversal could be imminent due to an overreaction in market sentiment.

The liquidations came as bitcoin open interest hit record high levels earlier this week at over $43 billion, dropping to just over $41 billion early Friday.