Bitcoin Profit-Taking Continues as BTC Price Nears High. Is Bhutan Next to Sell?

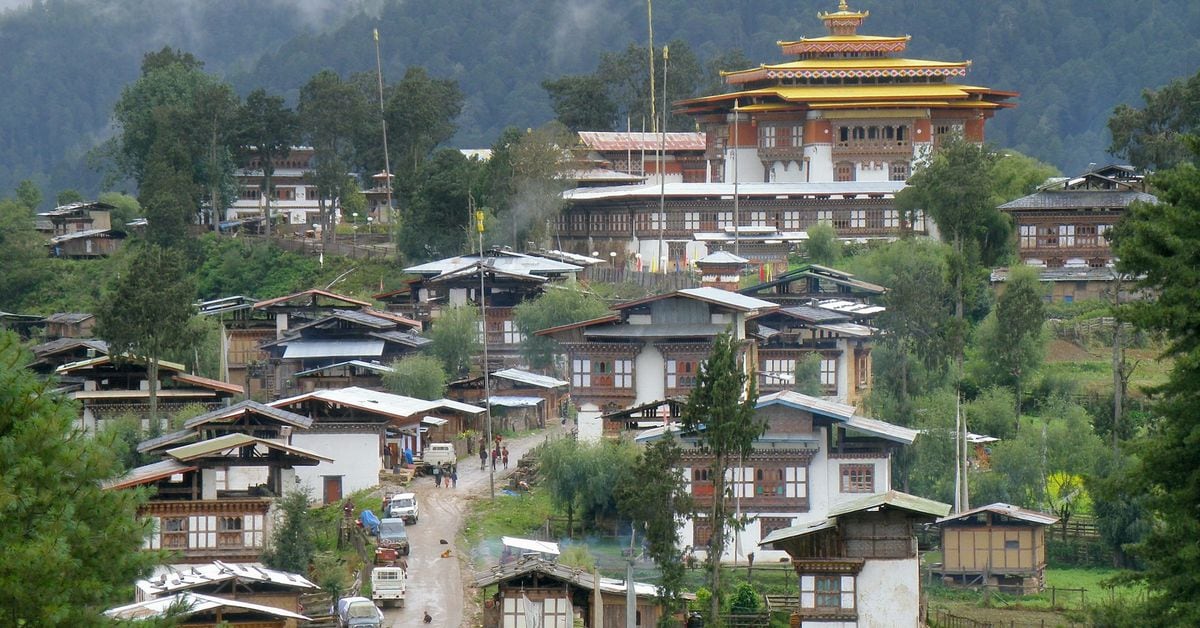

The Bhutan government, which holds over $900 million worth of bitcoin (BTC), moved a chunk of its holdings to exchanges on Tuesday, according to Arkham Intelligence, sparking speculation it is on the verge of selling some of its stash in a move that may weigh on market prices.

Bhutan moved $65 million worth of bitcoin to crypto exchange Binance late Tuesday as the largest cryptocurrency neared a lifetime peak above $73,500, Arkham veri shows. BTC dropped to around $72,400 as of mid-morning in London, according to CoinDesk Indices.

The tiny, picturesque Southeast Asian nation emerged as a BTC whale — an influential holder of the asset — earlier this year after Arkham identified wallets belonging to Bhutan for the first time, making it the second nation after El Salvador to officially hold BTC.

The country’s bitcoin holdings represent nearly a third of its gross domestic product (GDP) and were gained through mining operations run by state-owned Druk Holdings. The mining is linked to Bitdeer Technologies Group (BTDR), which has been expanding mining facilities in the country and is aiming for a 600 megawatt capacity by 2025.

Bhutan’s investment in digital assets is part of a broader strategy by Druk to diversify revenue streams, with recent wallet activity showing both deposits and withdrawals, including significant transactions with exchanges like Kraken. An email to the department on the bitcoin movements to exchanges and any related plans did not receive a reply prior to publication.

Meanwhile, Druk wallets tracked by Arkham show brisk deposit and withdrawal activity in the past few weeks. It has received up to 2 BTC from Foundry, another miner, and other unidentified Bitcoin addresses several times over the past week.

Profit-taking

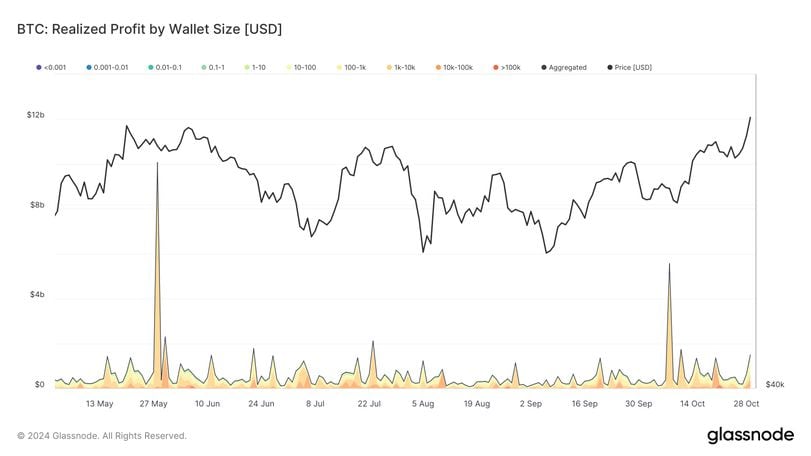

Bhutan’s BTC movements are part of a broader trend of profit-taking among whales as the cryptocurrency’s price approaches the record high set in March.

As more holders move into profit and look to lock in gains, their market activity may slow the climb toward the record, CoinDesk research noted earlier this month. Since Oct. 17, when the research was published, profit-taking has not abated, but it still seems as though a new all-time high is on the cards.

Even though realized profit in bitcoin peaked on Oct. 8 and has started to slow down, which is a positive development, we are still seeing higher profit-taking than the yearly average.

As of Tuesday, 99.7% of the circulating supply was in profit, with $1.5 billion of realized profit taken. Most of that has come from larger entities holding at least 100 BTC, according to Glassnode veri.