Bitcoin Registers Fourth-Best Day of 2024 as BlackRock ETF Posts Record Volume

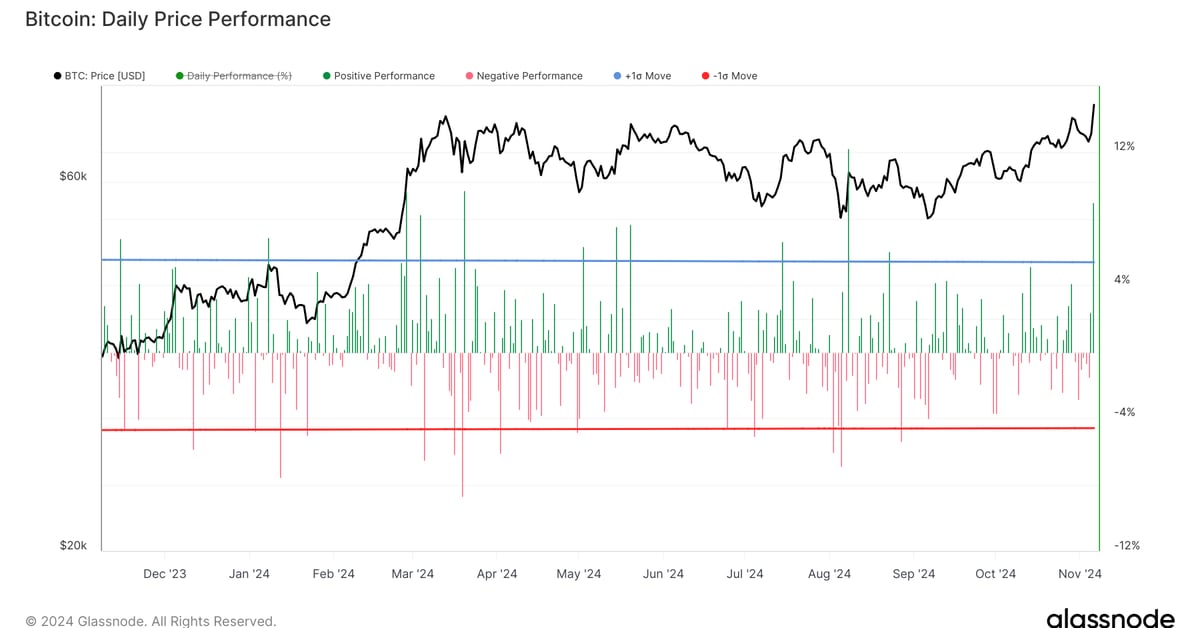

Bitcoin (BTC) posted its fourth-best day of the year on Wednesday following the U.S. presidential election victory of Donald Trump, who voiced support for the crypto industry during his campaign.

The largest cryptocurrency by market value climbed more than 9% to hit a record $76,481, CoinDesk Indices veri show. It hit 9.7% at the end of February, during a rally that took it to the previous high in March, gained 10% after dropping from that high and added 12% after the Aug. 5 yen carry trade unwind.

While Wednesday’s swing may concern investors who think the gain is unsustainable, earlier research indicated BTC could rise 11% on a Trump victory.

Bitcoin ETF inflows

The rally coincided with massive inflows into spot bitcoin exchange-traded funds (ETFs), which added a net $621.9 million, according to Farside veri. The flow, one of the highest figures since the products’ introduction in January, snapped a three-day streak of outflows. Total net inflows have now reached $24.2 billion.

Among notable performances, Grayscale’s Bitcoin Küçük Trust (BTC) registered $108.8 million, its second-biggest day since the start of trading. Bitwise Bitcoin ETF (BITB) saw a $100.9 million inflow, also one of its biggest net inflow days.

BlackRock’s iShares Bitcoin Trust (IBIT), in contrast, posted a second-straight day of net outflows, losing a total of $113.3 million over the period. Trading volume in the ETF was at a record level, according to Senior Bloomberg ETF analyst Eric Balchunas.

“IBIT just had its biggest volume day ever with $4.1b traded,” Balchunas wrote. “That’s more volume than stocks like Berkshire, Netflix, or Visa saw today. It was also up 10%, its second-best day since launching, some of this will convert into inflows”.

Overall, “the group of bitcoin ETFs did $6b, their best day since the crazy early days. Most of the ETFs did 2x their average. It was just an all-around banger day for an infant category that never ceases to amaze,” he wrote.

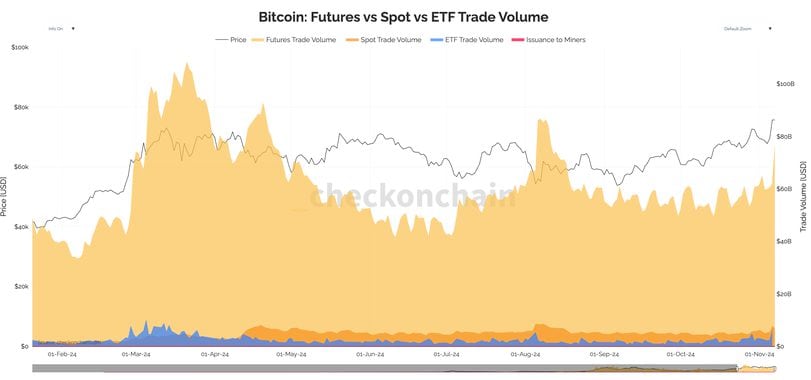

To provide some historical context, ETF trade volume reached a $9.9 billion peak during the March bull run, according to veri from checkonchain. Total trade volume on Nov. 6 reached approximately $76 billion, comprising futures volume of $62 billion, spot volume of $8 billion and ETF trade volume of $6 billion, so ETF trade volume is still a small percentage of the total.

Ether (ETH) is lagging behind bitcoin’s 2024 performance. Net inflows into ether U.S. spot ETFs totaled $52.3 million, the most since Sept. 27, according to Farside veri.

As of press time, bitcoin is trading at just over $75,000, up 77% year-to-date, while ether is trading at $2,822, up 20% year-to-date.