Bitcoin’s Bull Run Against Gold Could Accelerate as U.S.-China Trade Tensions Ease: Chart Analysis

Over the past two weeks, bitcoin (BTC) has significantly outperformed gold (XAU), and the bullish trend could intensify further.

This outlook is supported by bullish developments in the bitcoin-to-gold ratio, which measures BTC’s USD price against gold’s USD price per ounce and easing U.S.-China trade tensions.

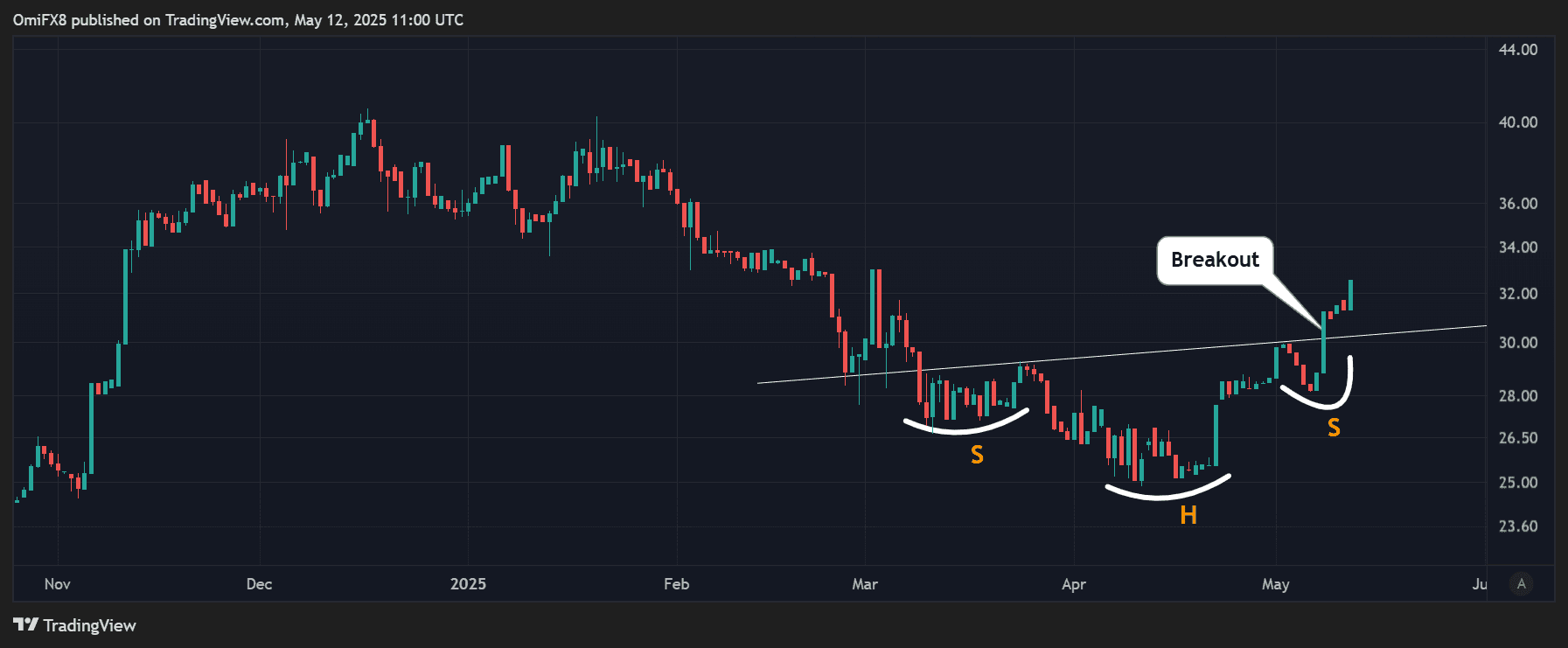

Recently, the ratio broke out of an inverse head-and-shoulders pattern, a classic bottoming formation characterized by a large trough flanked by two smaller ones, with a trendline connecting the recoveries between troughs. The breakout indicates bearish-to-bullish trend change, signaling further bitcoin outperformance.

Last week, the ratio topped the trendline, and technical analysis suggests it could rise to at least 35.00 from the current 32.00. This target is derived by adding the spread between the largest trough and the trendline to the breakout point, signaling a potential move higher for Bitcoin relative to gold.

The bullish technical set-up is consistent with past veri that shows BTC tends to catchup with gold rallies.

Gold’s meteoric rally peaked above $3,500 on April 22, and since then, the safe haven yellow metal has pulled back over 8% to $3,211, per TradingView veri. During the same time frame, BTC’s price has risen by nearly 19% to $104,000.

With the U.S. and China easing trade tensions early Monday, gold could lose ground while renewed risk-on sentiment powers BTC higher.

The two nations agreed to lower tariffs on goods manufactured in both countries, according to a joint statement released in Geneva. China has proposed to reduce tariffs on U.S goods to 10% from 125% for 90 days. Meanwhile, the U.S. has proposed cutting tariffs on Chinese goods to 30% from 145%.

“The tariff reduction could see a broader return to risk-on positioning, with crypto and equities both likely to benefit from renewed investor confidence and küresel capital flows,” Mena Theodorou, co-founder of crypto exchange Coinstash, told CoinDesk in an email.

“The rally comes as the macro backdrop takes a positive turn: in a landmark move, the U.S. has struck trade deals with both China and the UK, while Putin and Zelensky are set to meet on Thursday to discuss a potential ceasefire. These developments have lifted risk sentiment globally, crypto included,” Theodorou added.