Bitcoin’s Bull Run Could be Tested if BTC Falls Below $91K: Van Straten

Bitcoin (BTC) fell just below $98,000, a near 10% drawdown from all time highs, with investors questioning the continuation of the bull run.

The fall was attributed to the concerns about China’s DeepSeek Artificial Intelligence hyper-efficient model competing with the U.S. industry at a fraction of the cost.

Since President Trump won the U.S. election, bitcoin has jumped from $66,000 to new all-time highs of $109,000. During the rally BTC corrected as much as 15% twice, in addition to multiple double-digit drawdowns. Therefore, bitcoin’s 10% drop seems in line with previous drawdowns.

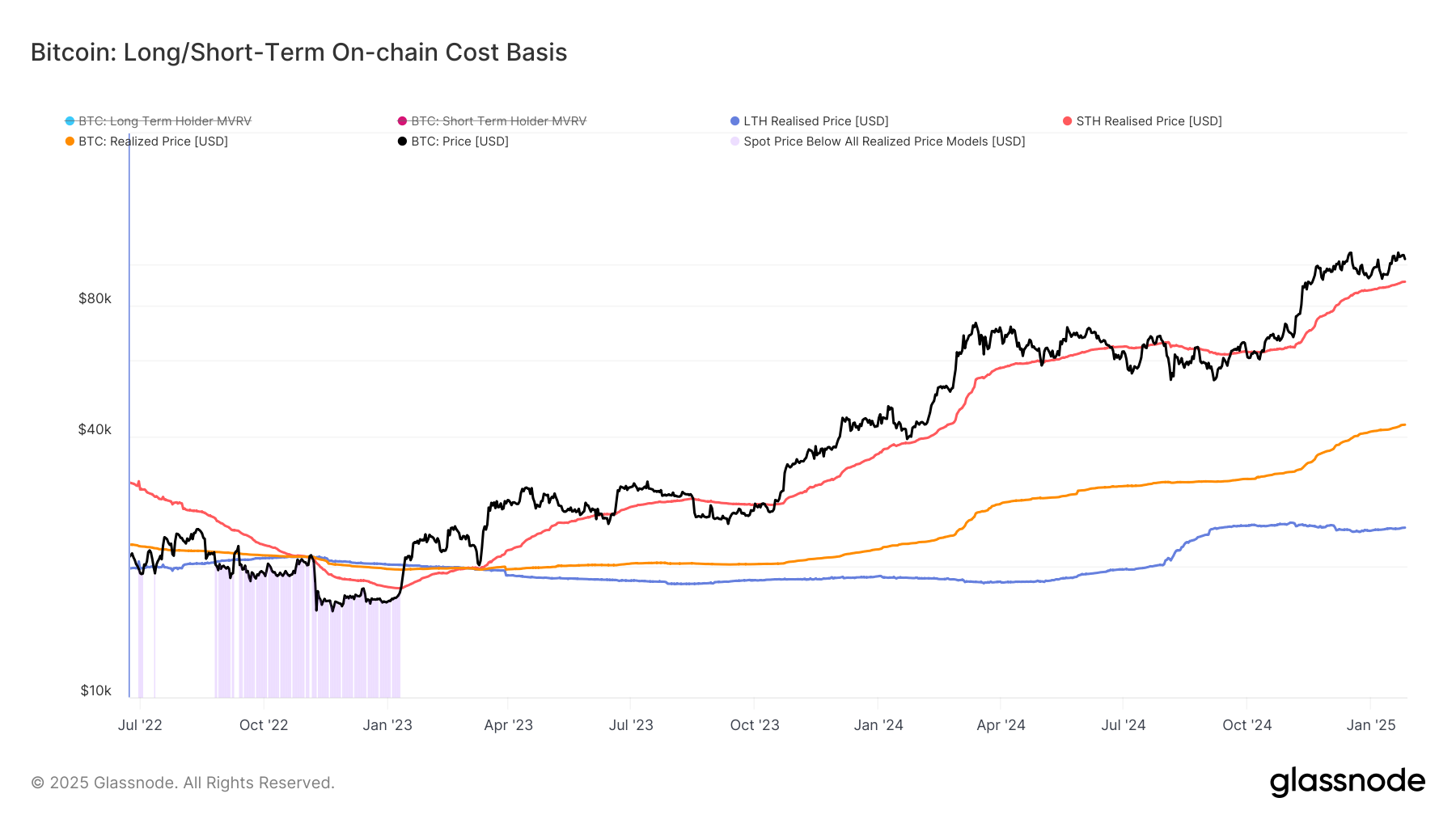

A reliable indicator of support during a bull market is the short-term holder cost basis, which is the average on-chain cost for coins that have moved within the last 155 days. This level is around $91,000 at the moment, which means if BTC falls below that point it could put a strain on the bull run.

But bearish sentiment is already starting to heat up, as funding rates for bitcoin have started to go negative. Also Arthur Hayes, co-founder of Bitmex, is calling for a correction between $70,000-$75,000, before seeing $250,000. CoinDesk’s Omkar Godbole also reported that bitcoin may drop to $75,000 should it trigger a so-called ‘double top’ bearish reversal pattern.

The drawdown hasn’t been contained to just crypto; U.S. markets are selling off, with Nasdaq futures down as much as 4%.