Shares of Cantor Equity Partners (CEP) surged 55% on Tuesday and are up an additional 15% in pre-market trading, trading below $19.

The skyward movement was driven by investor optimism around its proposed merger with Twenty One Capital a bitcoin (BTC) native investment vehicle backed by Tether, Bitfinex, and SoftBank.

Led by Strike CEO Jack Mallers and Brandon Lutnick, Twenty One Capital is being positioned as a public proxy for bitcoin, potentially holding over 42,000 BTC at launch and introducing metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to measure shareholder value in BTC terms.

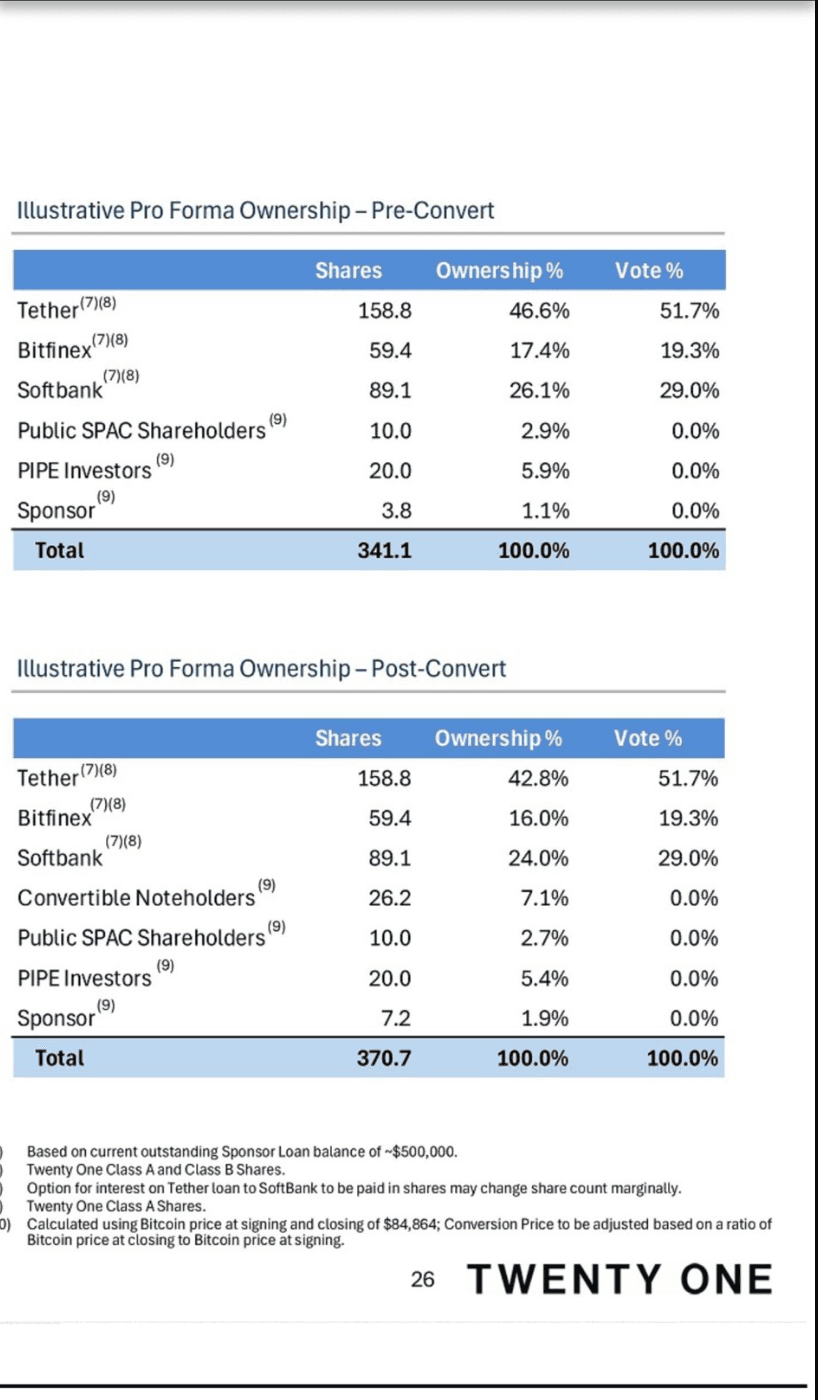

According to the latest pro forma ownership tables, Tether will control 42.8% of equity and 51.7% of voting power, while Bitfinex and SoftBank hold 16.0% and 24.0% of the company respectively, post-convert. Public SPAC shareholders will retain just 2.7% ownership, underscoring the extreme dilution but significant upside if BTC rises.

With BTC trading near $94,000, and the entity holding nearly $4B in BTC exposure, investors are re-rating CEP as a high-leverage bet on institutional bitcoin adoption. The stock is set to re-list under ticker “XXI” evvel the merger is finalized.

Disclaimer: This article, or parts of it, was generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.