Crypto-Equities Surge as Bitcoin Holds Above Key Level Ahead of U.S. Market Open

Crypto-equities have rebounded following Donald Trump’s crypto strategic reserve announcement. With just hours until the U.S. market opens, bitcoin (BTC) remains above $92,000, recovering from its recent drop to $78,000.

As a result, crypto-related stocks have jumped after significant declines—Strategy (MSTR) rebounded 12% after dropping as much as 50% from its November high. Coinbase (COIN) and MARA (MARA) gained 10%, and IREN (IREN) rose 11%.

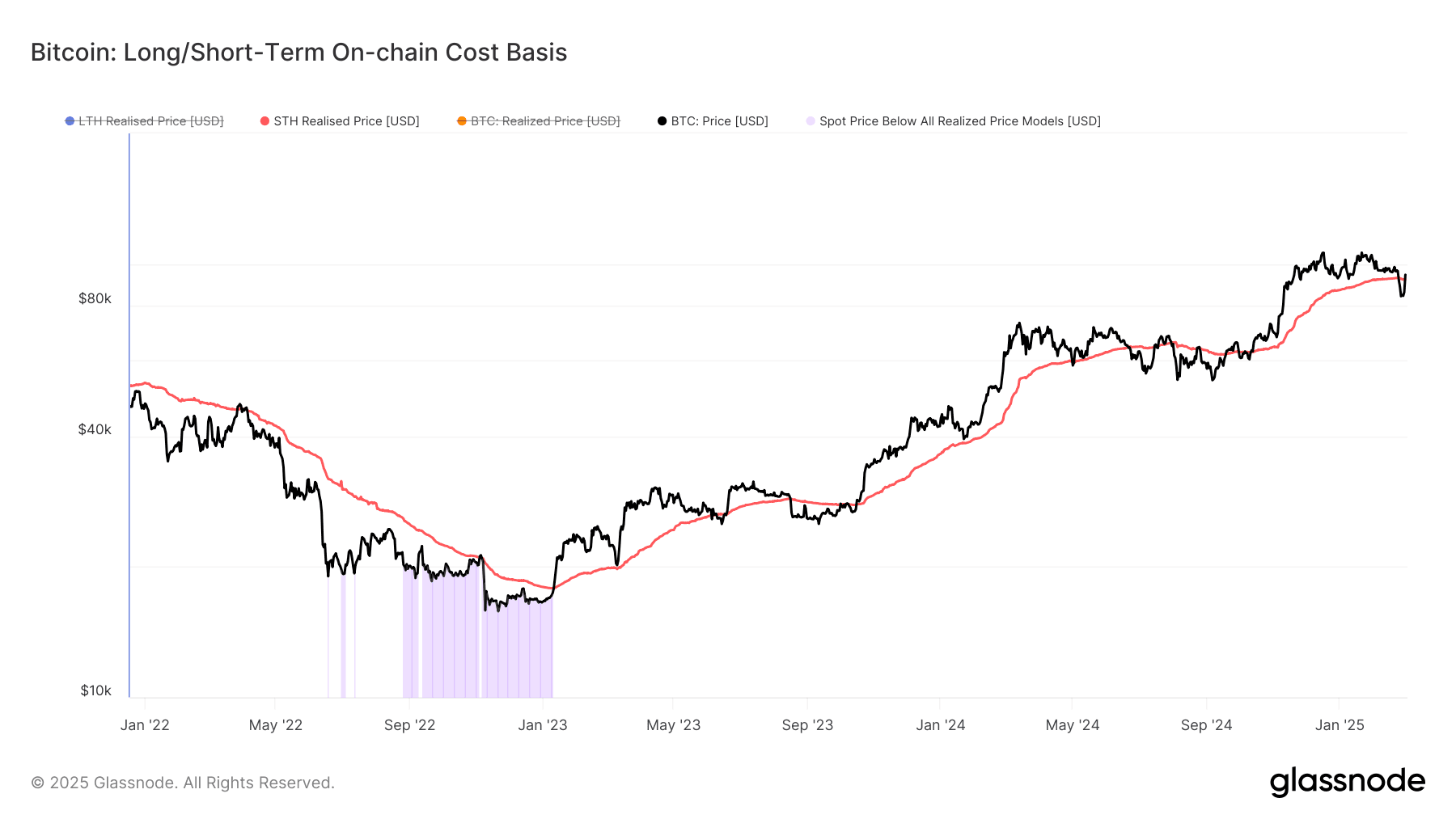

Glassnode veri shows that bitcoin also went above the Short-Term Holder Realized Price (STH RP) which is priced at $92,107, a key metric tracking the average on-chain cost for investors over the past 155 days. Historically, holding above this level signals a bullish continuation, though temporary dips occur, like in October 2023 and 2024, before further upside.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.