Ether, Dogecoin Surge Higher Than Bitcoin as DeFi Comments Spurs Bullish Mood

Bitcoin

stayed steady above $109,500 in Asian morning hours Wednesday, a rebound that started after last week’s profit-taking.

However, all eyes are on ether

with traders commenting on upside volatility in the weeks to come and reporting record volumes for certain ETH-based products on some exchanges. ETH zoomed 5% in the past 24 hours, leading gains among majors.

“Investors are finally recognizing the compelling investment opportunity that Ethereum presents. It’s still trading well below its all-time highs, while bitcoin is already near its ATH levels,” said Jeff Mei, COO at BTSE, in a message to CoinDesk.

He pointed to Ethereum’s growing role in tokenizing real-world assets like stocks, money-market funds, and U.S. Treasuries, adding that it was “very likely that Ethereum will reach and/or surpass its all-time high price by the end of the year.”

Ether ETFs have attracted more than $800 million in the past two weeks alone, outpacing bitcoin’s sub-$400 million, according to SoSoValue veri. That’s helped the spread between ether’s implied volatility and bitcoin’s reach its highest level since late 2022 — a sign traders expect bigger price swings ahead.

Open interest in ether perpetuals on Kraken hit an all-time high of 30,000 ETH this week, said Alexia Theodorou, Head of Derivatives at Kraken, in an email to CoinDesk.

“This signals a notable uptick in speculative activity around the second-largest cryptocurrency by market cap,” she noted. However, she cautioned that the market “has yet to form a clear directional consensus,” with the long/short ratio still well below January levels.

Elsewhere in the market, Solana

and Cardano

posted gains of 4.7% and 3.3%, respectively, adding to the risk-on tone, while XRP

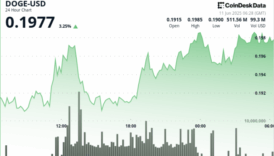

rose 2% to $2.30. Ethereum beta bet dogecoin

climbed 3.7% to reverse all of last week’s losses.

Traders are closely watching upcoming U.S. CPI veri on Wednesday, which could sway Federal Reserve rate expectations and shape risk sentiment ahead of next week’s meeting.