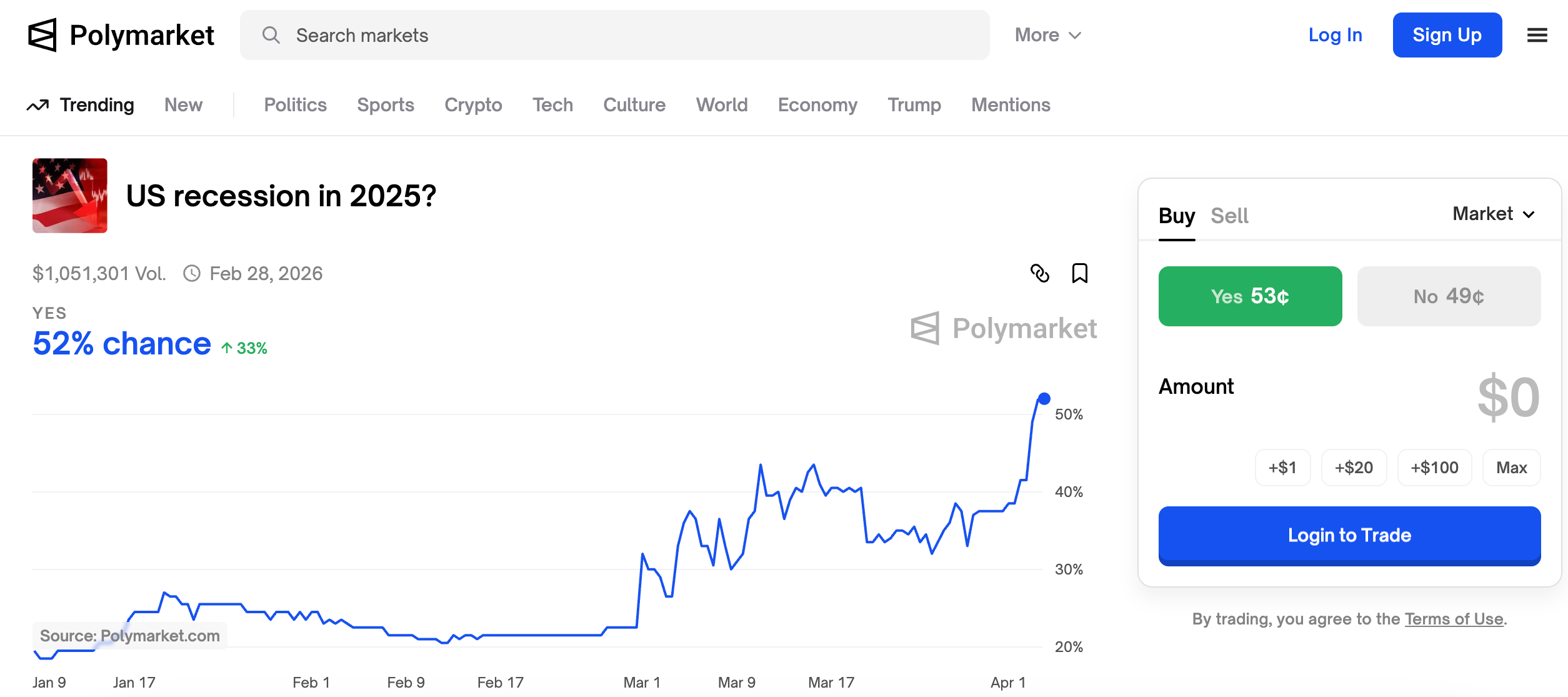

Ether’s Leverage-Driven Rally Faces Breakdown Risk, Matrixport Warns

Ether’s

recent rally may be on shaky ground with one firm warning that last week’s price surge was largely fueled by speculative futures positions instead of a bump in organic demand.

In a note on Monday, Matrixport opined that “leveraged traders have pushed [ETH’s] price higher in the absence of fundamental support,” adding that this made the asset more susceptible to the “outsized decline” the asset saw over the weekend.

Ether slumped over 8% in a Saturday sell-off, leading losses among majors as traders reacted to the U.S. attack on Iranian nuclear sites in a surprise airstrike.

📊 Today’s #Matrixport Daily Chart – June 23, 2025 👇

Why Ethereum’s Drop Isn’t Over—and What Futures Positioning Is Telling Us Now#Matrixport #Bitcoin #BTC #Ethereum #ETH #CryptoMarket #CryptoTrading #ETHPrice pic.twitter.com/a6T3as8ar1

— Matrixport Official (@Matrixport_EN) June 23, 2025

The firm pointed to last week’s sharp drop in ETH as evidence of this position-driven fragility and warned that elevated leverage levels could continue to pressure prices.

At press time, ETH traded near $2,248 — down from last week’s high above $2,400 — as derivatives veri showed traders aggressively hedging downside risk.

Options market signals echo that caution, as CoinDesk analyst Omkar Godbole noted over the weekend. According to veri from Amberdata, ETH’s 25-delta risk reversals — a measure comparing the cost of puts versus calls — have skewed negative across June to July expiries. This suggests investors are paying up for protection against downside volatility.

QCP Capital further noted in a weekend market update that “risk reversals in both BTC and ETH continue to show a preference for downside protection,” adding that long holders are actively hedging their spot exposure.