Global Tokenized Real Estate Market Could Explode to $4T by 2035, Deloitte Forecasts

Real estate tokenization—once a niche experiment—may soon become a core pillar of how property is financed, owned and traded, according to a Thursday report by Deloitte Center for Financial Services.

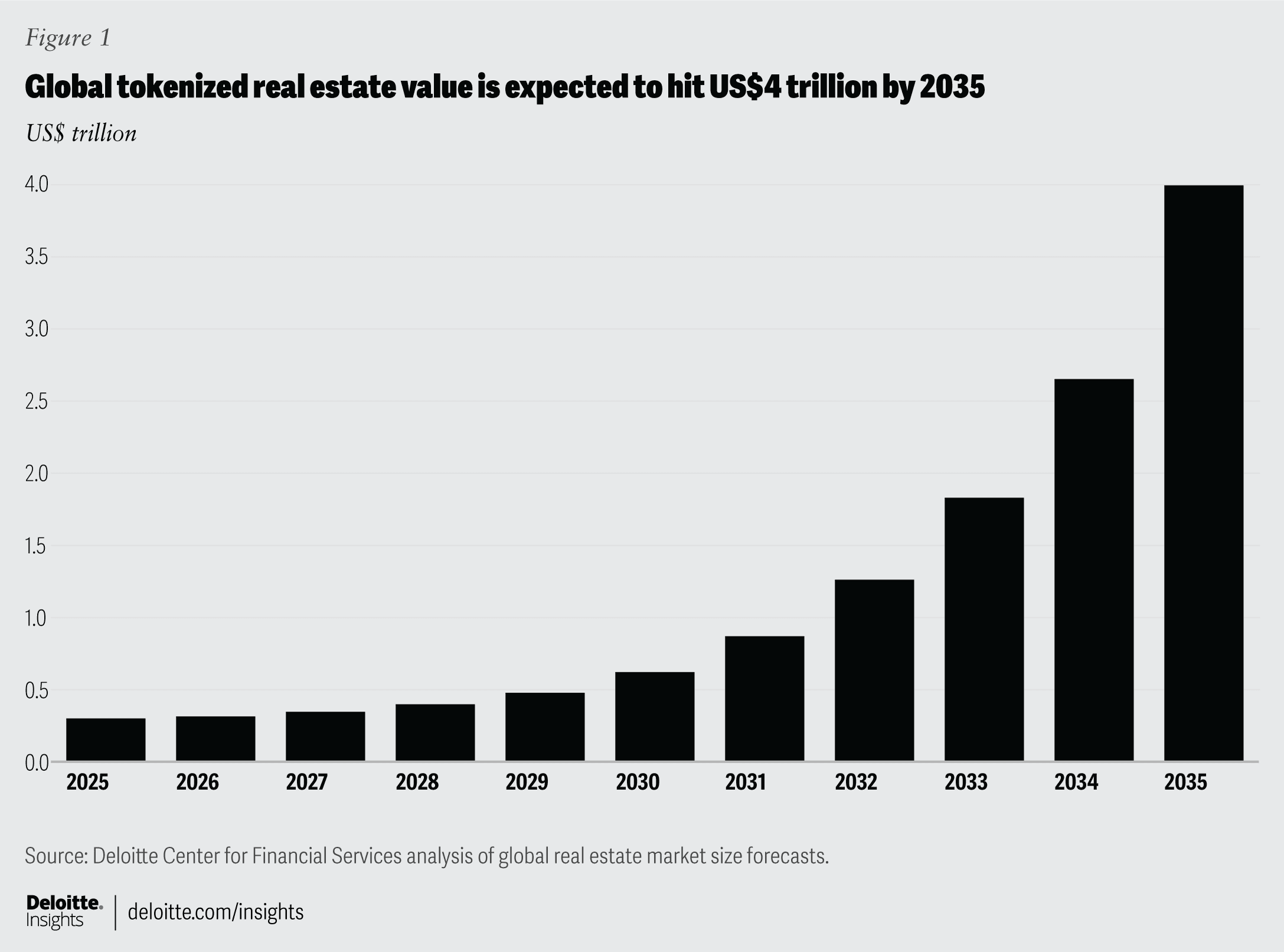

The market of tokenized real estate could reach $4 trillion by 2035, growing at a compound annual rate of 27% from the current size of under $300 billion, the firm forecasted.

Tokenization of real-world assets (RWA) is a red-hot sector at the intersection of crypto tech and traditional finance. It consists of creating digital versions of assets like bonds, funds and real estate, that represent ownerships on blockchain rails.

The process offers operational efficiencies, cheaper and faster settlements and broader investor access.

For the real estate sector, tokenization’s appeal lies in its ability to automate and simplify complex financial agreements, the report explained, such as launching a real estate fund on-chain with coded rules handling ownership transfers and capital flows. An example for this is Kin Capital’s $100 million real estate debt fund tokenization platform Chintai with trust-deed-based lending, Deloitte noted.

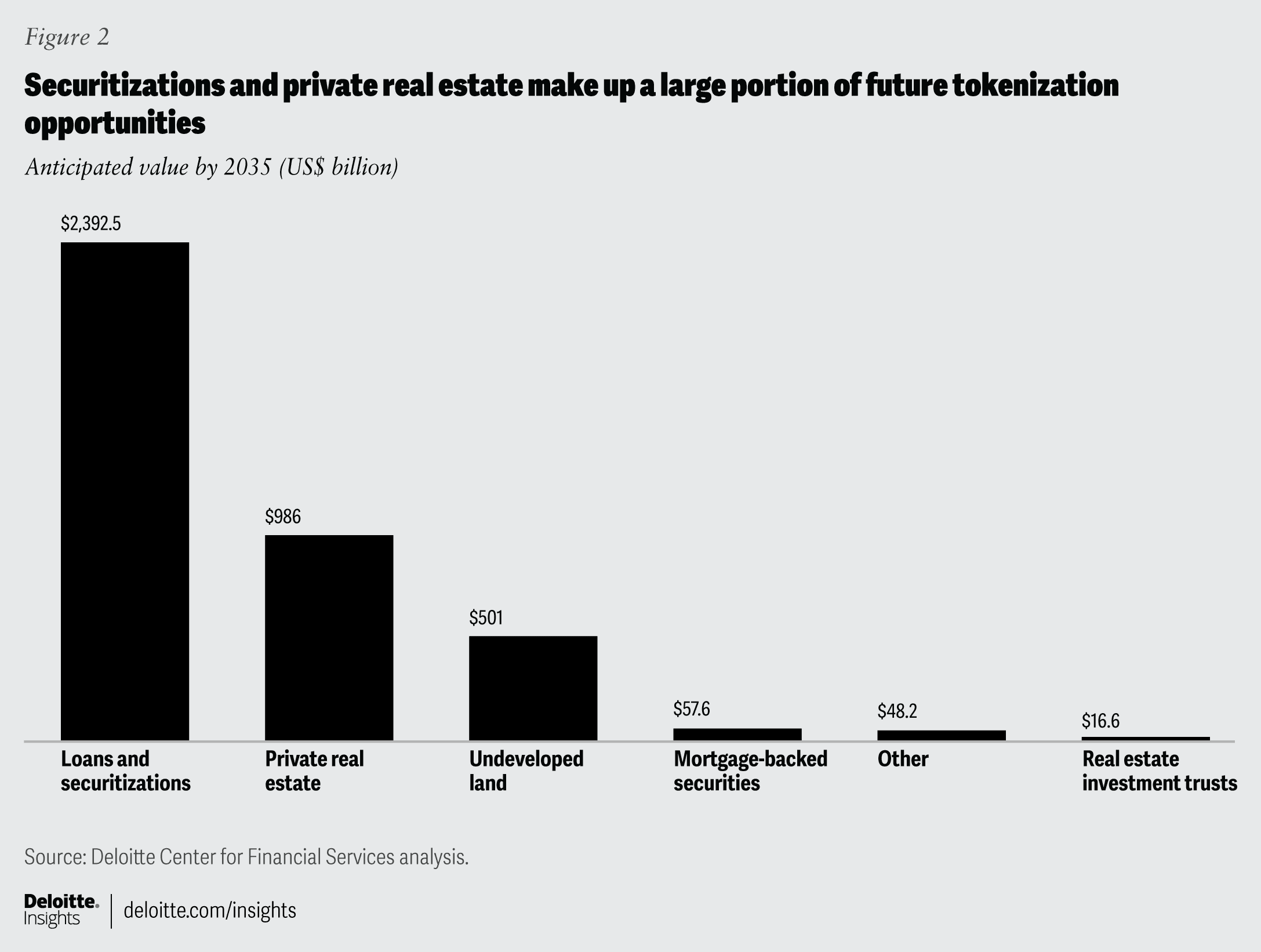

The report outlines a three-pronged evolution of tokenized property: private real estate funds, securitized loan ownership, and under-construction or undeveloped land projects. Of these, tokenized debt securities are expected to dominate, hitting $2.39 trillion in value by 2035, based on the report’s forecast. Private funds could contribute around $1 trillion, while land development assets may account for some $500 billion.

Despite the advantages, challenges remain, the report noted, especially around regulation, asset custody, cybersecurity and default scenarios.