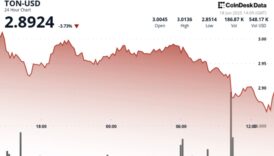

KuCoin Allows Institutional Clients to Trade Without Having to Pre-Fund Wallets

Crypto exchange KuCoin is now allowing institutional clients to trade without having to pre-fund wallets, recreating a trading experience that they would recognize from the traditional finance (TradFi) world.

The Seychelles-based exchange teamed up with BitGo Singapore and will use the crypto custodian’s Go Network for off-exchange settlement (OES), KuCoin said.

“KuCoin’s full suite of products — spot, margin, options, and perpetual futures — can now be accessed through Go Network, ensuring assets remain protected,” the exchange said in Thursday’s announcement.

As crypto companies seek to cash in on increasing crypto institutional adoption, they’re faced with having to introduce tools that a familiar in TradFi. In this case, institutional clients’ assets remain in BitGo Singapore’s storage, following the model of separating custody and execution to mitigate counterparty and systemic risk.

For some, what KuCoin aims to offer has an echo of the now defunct Silvergate Bank’s Exchange Network (SEN) platform, which helped institutions move funds to exchanges. The bank discontinued the service in March 2023 shortly before it entered liquidation during the crypto winter that had built throughout 2022 and came to a head with the collapse of FTX the previous November.