Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Riot Platforms (RIOT) reported strong operational performance in March 2025, highlighted by continued expansion into the artificial intelligence (AI) and high-performance computing (HPC) sector.

The company’s bitcoin (BTC) production last month rose to 533 BTC, the most since the reward halving almost a year ago. The figure represents a month-on-month increase of 13% and 25% more than a year before. Bitcoin holdings grew to 19,223 BTC.

Riot said it plans to “aggressively pursue” development of its Corsicana facility to capitalize on rising demand for compute infrastructure used in AI and HPC.

A recently completed feasibility study by industry consultant Altman Solon confirmed the significant potential of the site to support up to 600 megawatts of additional capacity for AI/HPC applications. Key advantages include 1.0 gigawatt of secured power, 400 MW of which is already operational, 265 acres of land with substantial development potential and close proximity to Dallas — a major hub for AI and cloud computing.

The study noted the site’s ability to support both inference and cloud-based workloads, strengthening its appeal to AI/HPC tenants.

Riot maintained a steady deployed hash rate of 33.7 EH/s, while its average operating hash rate grew 3% month-over-month to 30.3 EH/s—representing a 254% increase year-over-year. Although power credits declined due to seasonal factors, Riot kept its all-in power cost low at 3.8 cents per kWh, and improved fleet efficiency to 21.0 J/TH, a 22% improvement from the previous year.

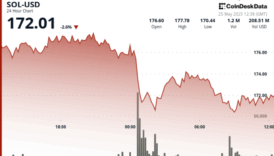

Riot’s shares fell 5.5% Friday, while the Nasdaq 100 index dropped 2.8%. They have lost 35% year-to-date.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.