Robinhood Crypto Revenue Expected to Fall in Q1 After Record Late 2024 Gain: JPMorgan

Robinhood’s (HOOD) record crypto trading revenue from the last quarter of 2024 may prove hard to repeat, according to JPMorgan analyst Kenneth Worthington, who forecast a drop in digital asset volumes for the first quarter of this year.

The online trading platform reports first quarter results after the U.S. market close on Wednesday.

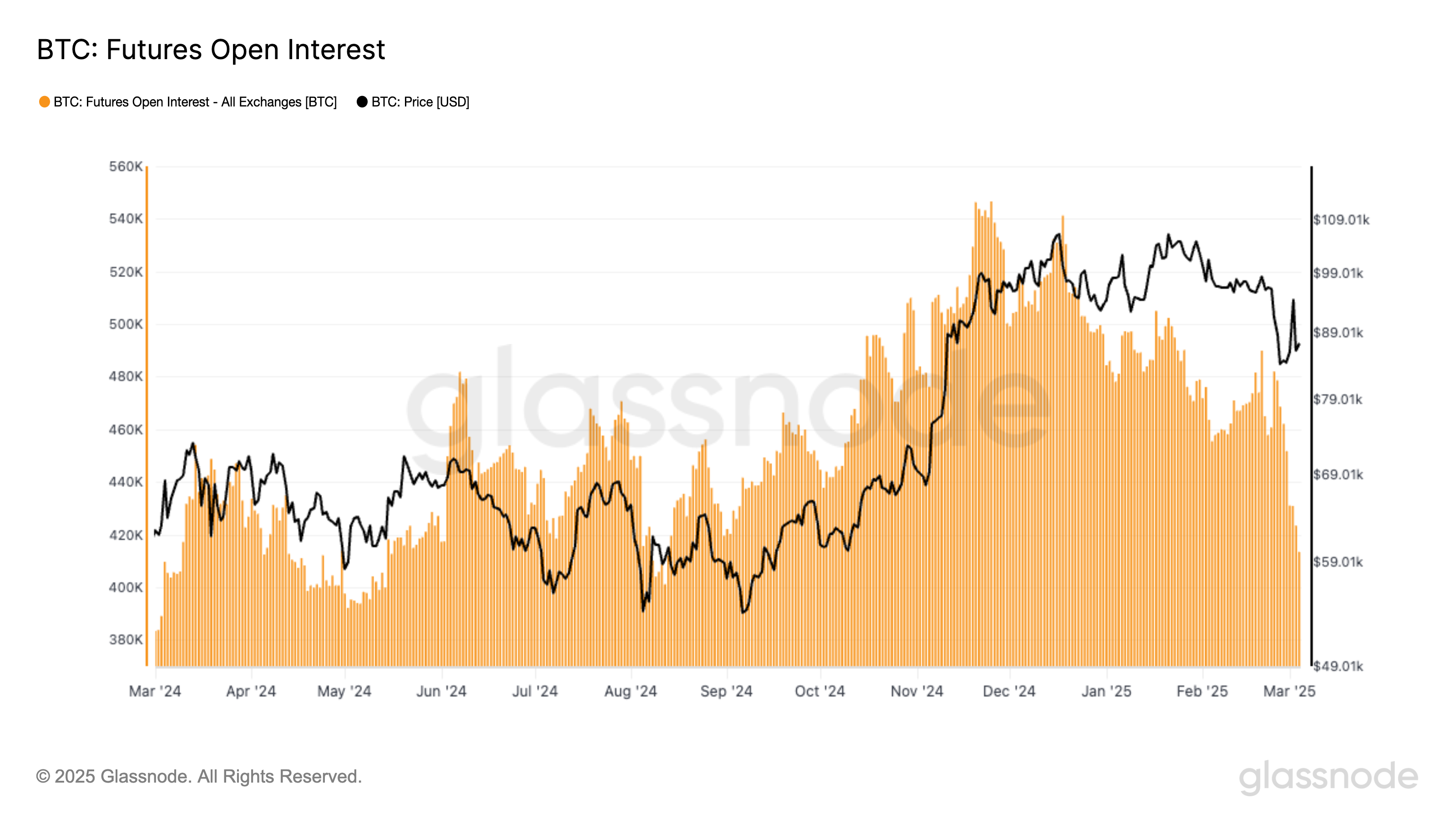

The fourth quarter’s staggering 700% surge in cryptocurrency trading revenue was behind a sizable jump in HOOD’s overall transaction-based revenue. Worthington, however, sees that momentum stalling in the first quarter, citing a decline in both equity and crypto markets, especially in the latter half of the quarter.

Worthington and team estimate Robinhood users traded about $52 billion in crypto during the quarter, down from $71 billion in Q4. Worthington attributes the drop to a “risk-off” environment that erased much of the market’s gains since the start of the year. Robinhood’s assets under custody (AUC) are expected to fall 5% from the prior quarter to $183.3 billion, though still up 41% year-over-year.

While the report highlights strong retail buying in early April following tariff-related news from Washington, Worthington suggests that activity may not be enough to lift first quarter results. He warns that softer demand for margin and derivatives trading — also seen at competitor Interactive Brokers — could weigh on Robinhood’s overall performance.

Worthington maintained a neutral rating on the stock and trimmed his price target by $1 to $44, suggesting about 10% downside from the current price just below $49.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.