Deribit

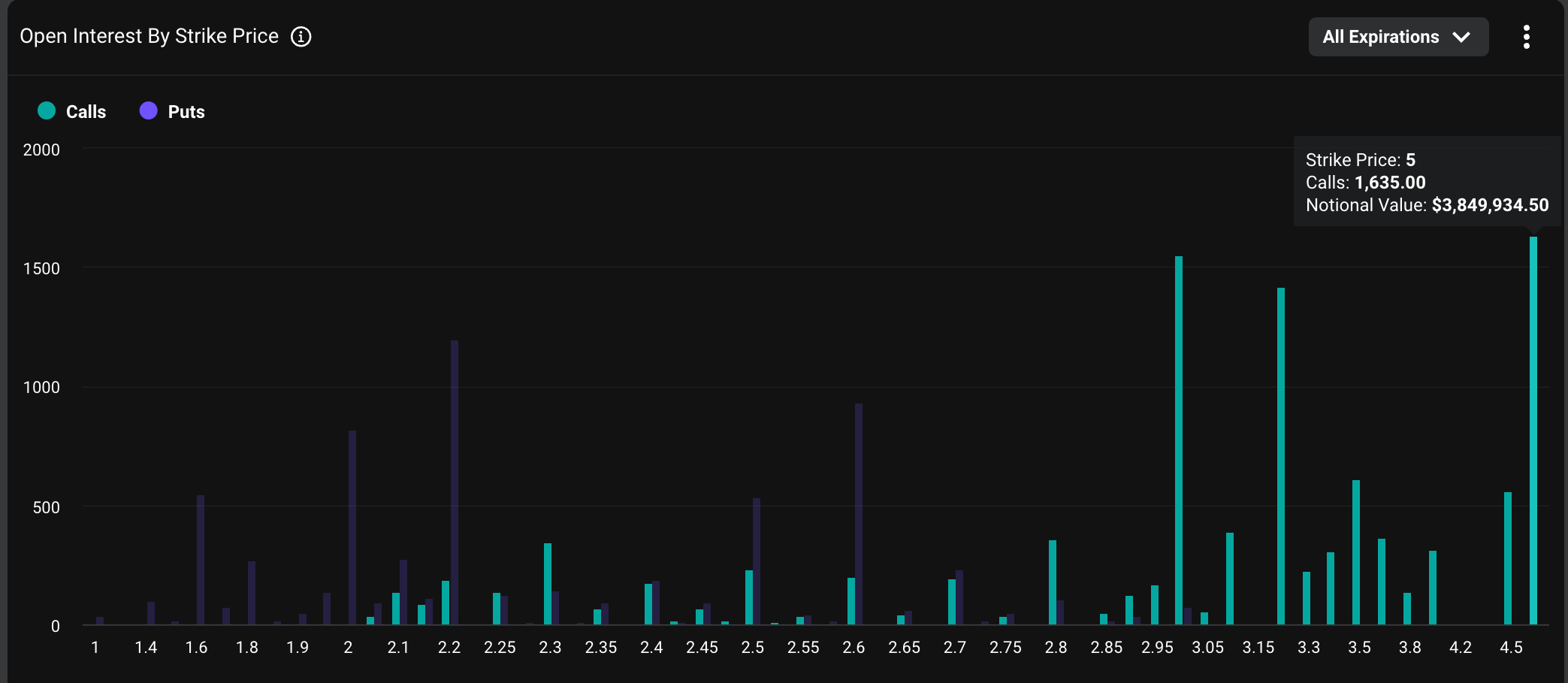

Bitcoin’s BTC$106,443.08 put-call ratio has jumped ahead of Friday’s multi-billion-dollar options expiry on Deribit, but its traditional bearish interpretation may not tell the full story this time. The put-call open interest ratio refers to the …

The institutionalization of cryptocurrencies is accelerating rapidly. Crypto derivatives exchange Deribit’s on-demand liquidity tool, the Deribit Block Request-for-Quote (RFQ) interface, has registered a cumulative trading volume of over $23 billion …

Coinbase has agreed to hisse $2.9 billion to buy bitcoin (BTC) and ether (ETH) options platform Deribit, according to a press release, marking its official push into the highly profitable crypto derivatives market in the U.S. The crypto exchange …

Most of these are covered calls, Deribit’s Asia business development head said.

A second source said U.S.-listed exchange Coinbase has also been kicking the tires of Deribit.

Total trading volume surged 95%, with options accounting for a giant share of the total platform activity.

The crypto options platform is reportedly working with FT Partners to assess takeover bids.

Options linked to BlackRock’s spot bitcoin ETF (IBIT) began trading on Nov. 19 and have since grown to half the size of Deribit’s BTC options market.