Market

AI tokens are struggling to perform despite bullish sentiment around AI stocks in traditional markets.

Stronger-than-expected job openings and ISM Services PMI rolled back investor expectations for further rate cuts for this year.

Whale transactions and large withdrawals from exchange signal demand for the largest memecoin by market capitalization.

A technical correction and reversal is close to being complete and could trigger a full-blown bullish move, some traders say.

Traders are positioning for a rally to record highs after President-elect Donald Trump takes office on Jan. 20

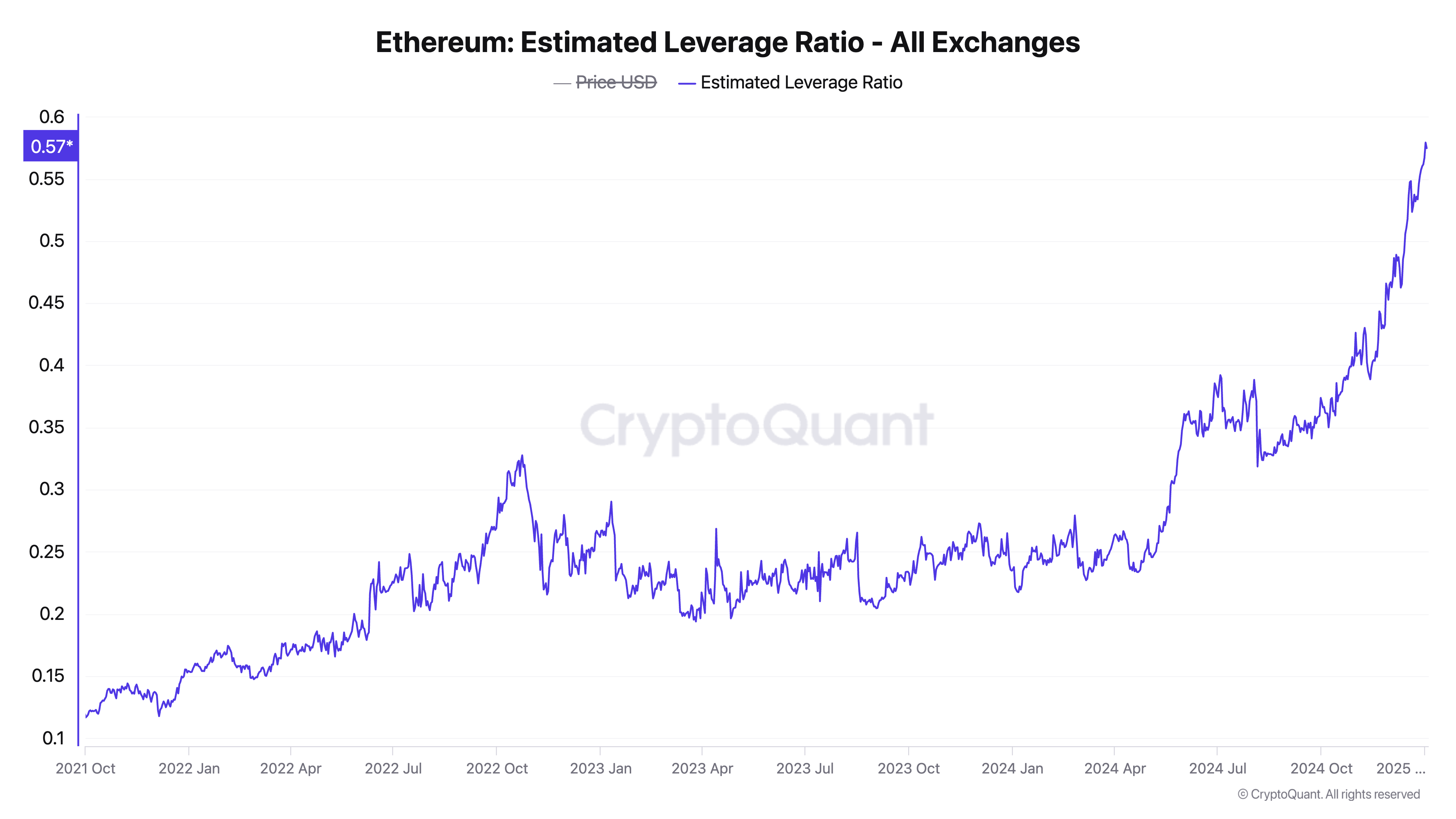

Ether stands out relative to BTC as the go-to major currency for traders looking to amplify returns with the use of leverage

BTC’s rally has stalled amid hawkish comments from the Fed officials.

“We believe that the underlying strength in BTC represents a systematic shift in the market in anticipation of Trump’s return to office,” QCP Capital traders said in a Friday broadcast.

Ethereum is by far the most popular blockchain for issuers of tokenized traditional assets with a current market cap of $1.6 billion.

The crypto custodian’s clients can use money market fund tokens as collateral in derivatives trades after the company received approval from the Financial Services Regulatory Authority (FSRA) in Abu Dhabi.