Price

The spot bitcoin ETFs saw sizable inflows in the first quarter despite the lame price action and at least one analyst sees the next three months as even bigger even if the prices don’t recover. “Even if current market conditions persist in the second …

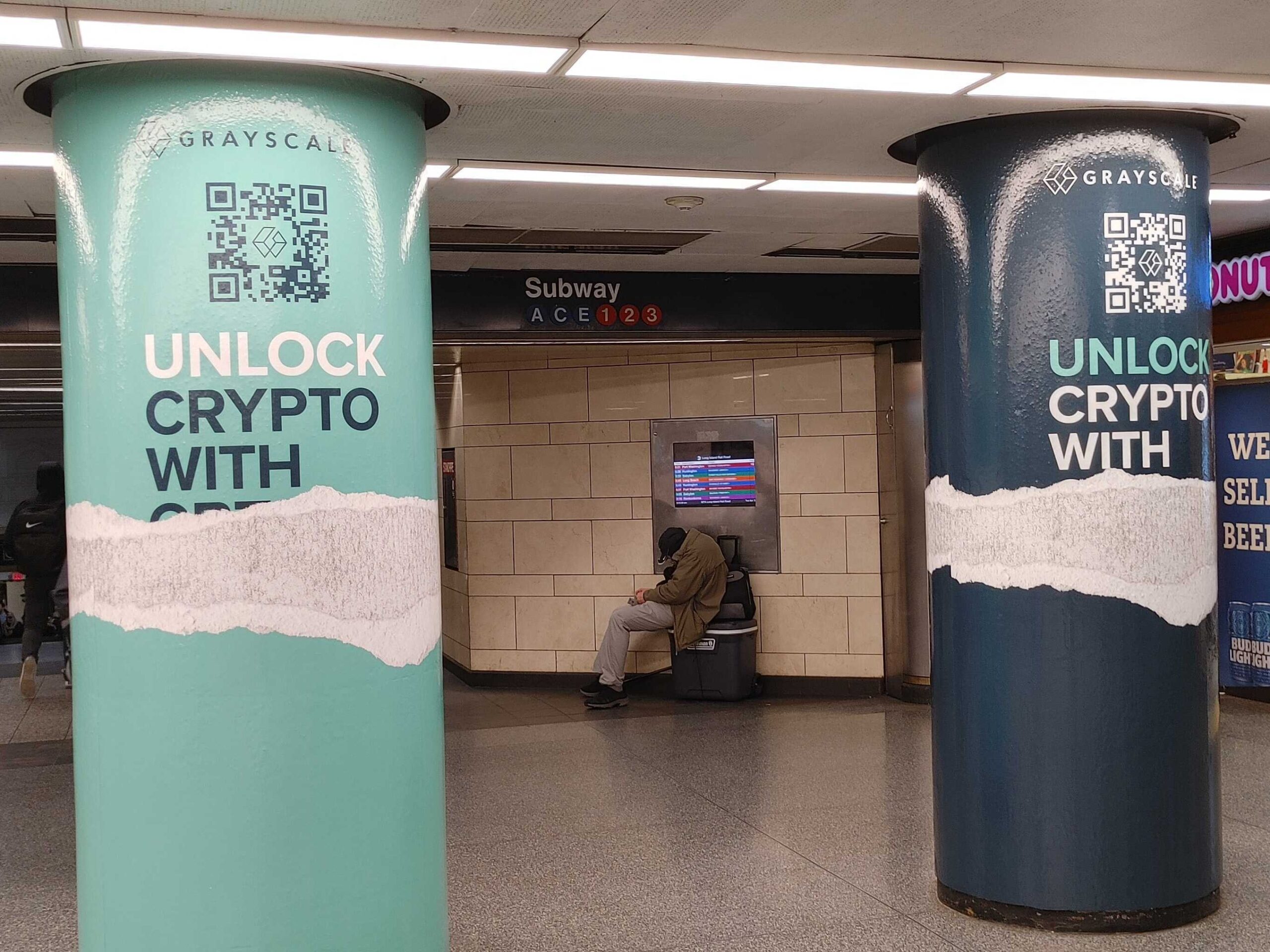

Crypto asset manager Grayscale has listed two new exchange-traded funds (ETFs) that offer investors a differentiated source of income through bitcoin’s (BTC) characteristic volatility. The two New York Stock Exchange-listed funds will start trading …

Wednesday could be a pivotal day for financial markets, including cryptocurrencies, as President Donald Trump is expected to announce sweeping reciprocal tariffs to “liberate” the U.S. from the supposed unfair practices of its trading …

Is Strategy (MSTR) in trouble? Led by Executive Chairman Michael Saylor, the firm formerly known as MicroStrategy has vacuumed up 506,137 bitcoin (BTC), currently worth roughly $44 billion at BTC’s current price near $87,000, in the span of about …

whichHyperliquidity Provider (HLP), a market making vault that is a part of derivatives exchange HyperLiquid, faced a grueling loss after a trader allegedly manipulated the price of the JELLY token. HyperLiquid’s native token (HYPE) fell by 20 …

Options pricing on Deribit suggests BTC could swing by nearly $5K following the crypto summit, according to analysis by STS Digital

The ETF saw over $1 billion in outflows last week alongside a surge in trading volumes.

CME gaps — price disparities caused by the exchange’s weekend closure while spot markets trade around the clock — tend to historically act as magnets for bitcoin prices.

Prices have pulled back to the descending trendline from Jan. 16 highs.

XRP, ETH, SOL and ADA price have also surged following Trump’s announcement.