Price

“Historically, CME gaps are filled eventually,” one analyst said.

In a worst case scenario, prices could slide to the $72,000–$74,000 range, one analyst said.

Bitcoin’s stumble begs the question asked during the last bear market: Is there a point at which Michael Saylor would be forced to liquidate part of the company’s near-500,000 BTC stack?

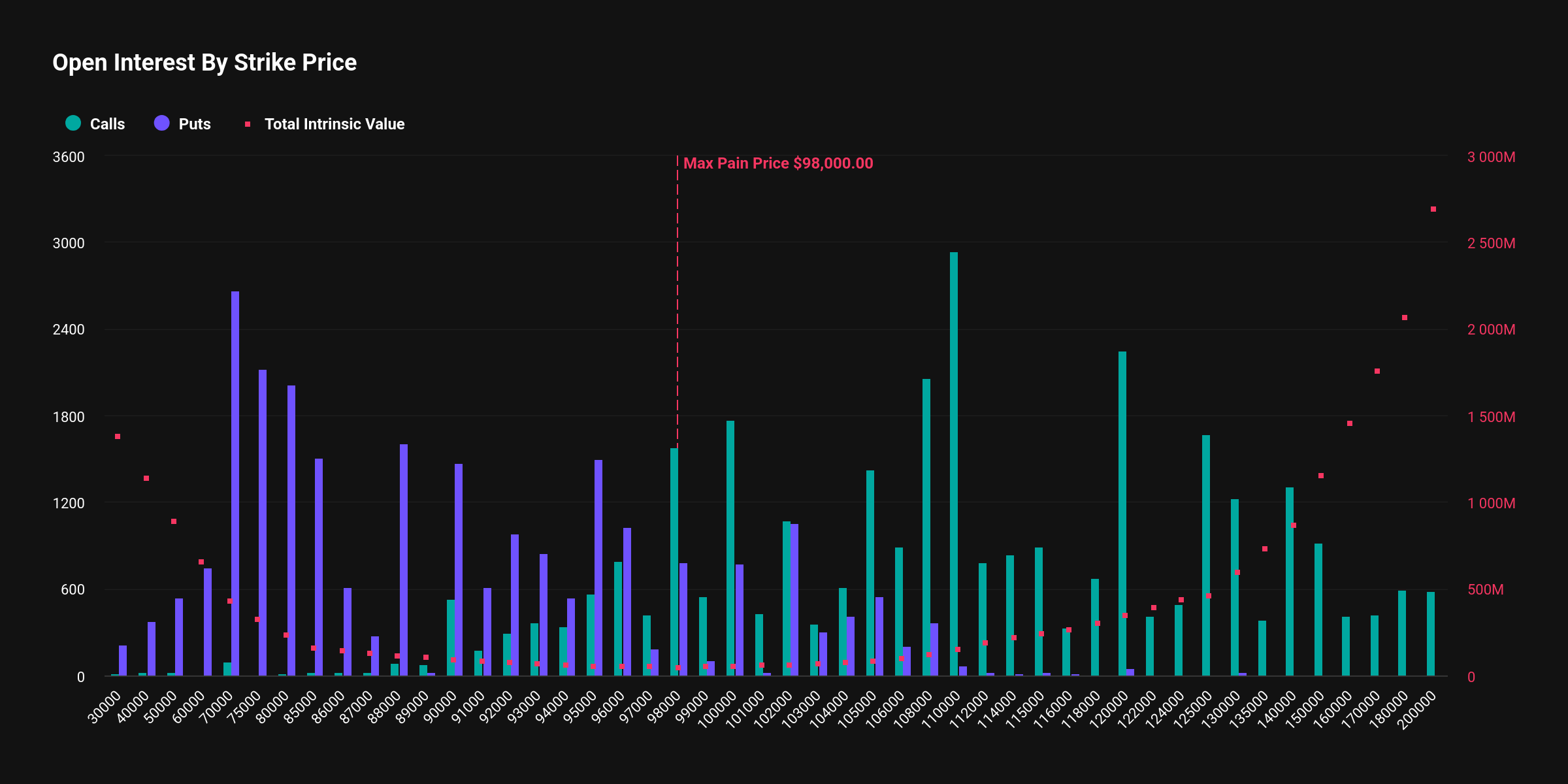

Over $5 billion of notional value is set to expire this Friday on Deribit at 08:00 UTC.

Futures activity hints at an influx of fresh shorts as Monday’s bearish marubozu candle points to more losses ahead.

Attendees at Consensus saw memecoins as net negative for the broader crypto market. Some expected the SEC to approve ETFs tied to top altcoins.

SOL put options accounted for most of the block trades that crossed the tape on Deribit last week.

Secondary markets for locked tokens refer to platforms or mechanisms where tokens that are under some form of lock-up or vesting schedule.

Gold’s price dropped while risk assets rose amid speculation Trump’s reciprocal tariffs are no more than a negotiating tool.

Past trends associated with the 200-week SMA suggests the ongoing range play between $90K and $110K will likely resolve bullishly.