Short

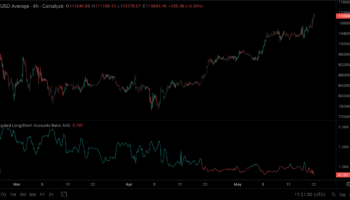

Bitcoin {BTC} galloped to a new record high above $110,000 on Thursday, liquidating around $500 million worth of derivatives positions in its wake, but some traders aren’t buying into the bullish sentiment. Trading volume jumped by 74% in the past 24 …

Bitcoin (BTC) enjoyed its weekly dose of volatility late Sunday, rising to around $107,000, before decisively plunging back to $102,000. The crypto market typically experiences a bump in volatility at this time on Sunday as it coincides with the …

Ether’s ETH$2,614.71 rally, though impressive, leaves much to be desired. That’s because the unwinding of shorts is said to be fueling the rally, not fresh longs or bullish leveraged bets on the Chicago Mercantile Exchange (CME). “The rally is …

A broad crypto rally led by ether’s (ETH) 20% surge triggered more than $750 million in short liquidations in the past 24 hours, the highest single-day total since 2023 for bearish trades. Veri from CoinGlass shows that over 84% of the total …

Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR) Traders shorting Strategy (MSTR), the bitcoin buyer whose share price gained 13% in March, may be struggling to find enough stock to repay the lenders who underpinned their …

The record short interest is led by carry trades and some amount of outright bearish bets on the second-largest cryptocurrency.

The renewed bearish flip in funding rates comes amid risk-off in Wall Street’s tech-heavy Nasdaq index.

BTC neared $95,000 in European morning hours Friday after a slump in U.S. hours sent it to near $90,000 late Thursday, down 10% from a weekly high above $120,000.