This

The U.S. digital assets exchange made a public-records request to add up what the regulator spent on crypto cases in recent years, including against Coinbase.

The Deribit-listed $100K strike call has seen the biggest jump in open interest in the past 24 hours.

In a worst case scenario, prices could slide to the $72,000–$74,000 range, one analyst said.

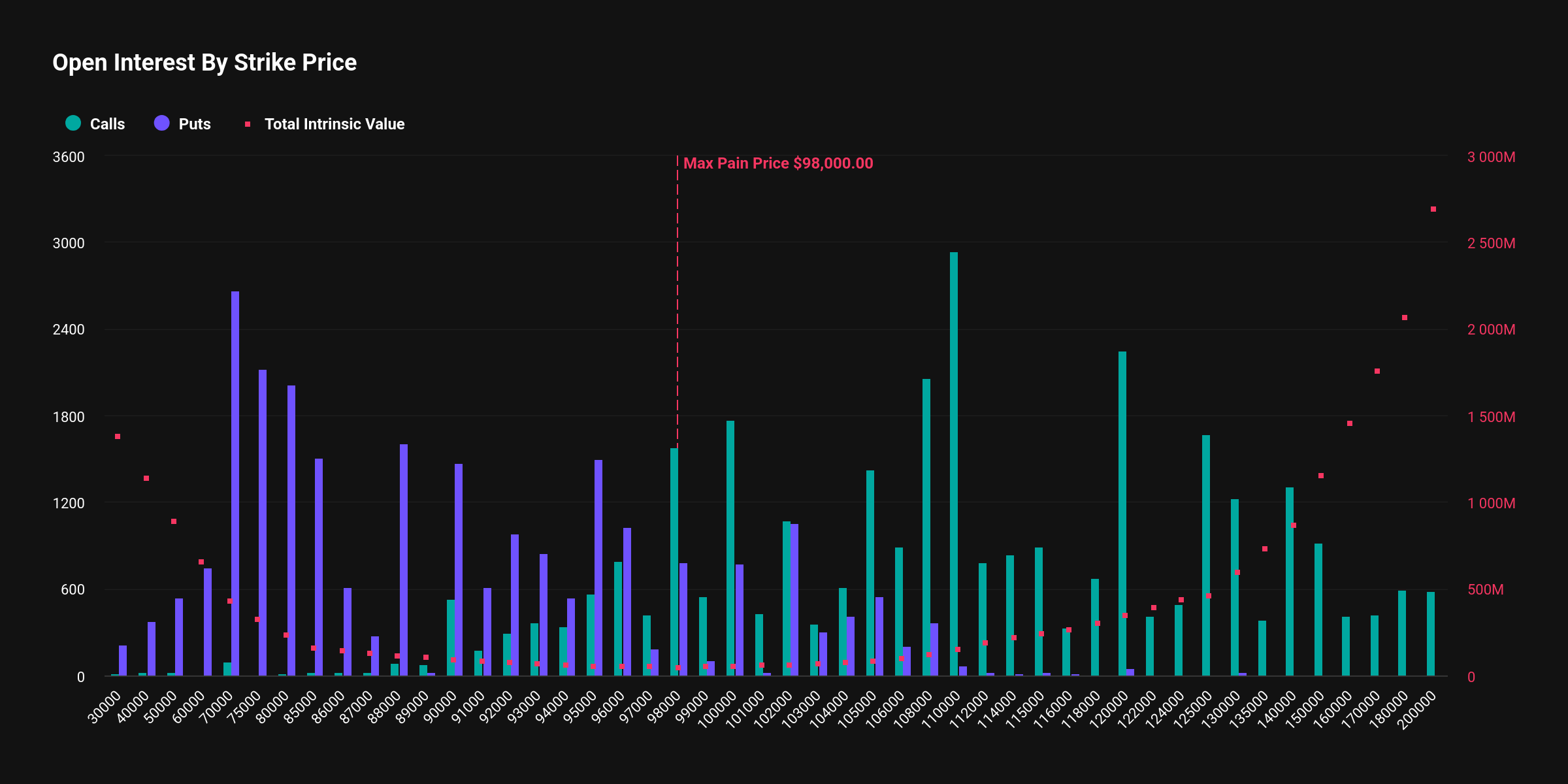

Over $5 billion of notional value is set to expire this Friday on Deribit at 08:00 UTC.

Public bitcoin miners are rushing to build AI business lines, but there’s still room for their original mandate, says this investment bank analyst.

The expansion significantly broadens trading options for users, reflecting a friendlier regulatory environment in the U.S.

Lazarus Group was behind Bybit’s $1.5 billion hack on Friday, Arkham Intelligence said, citing ZackXBT.

“At this point, memecoins are synonymous with ‘pump and dump’ schemes,” says FRNT Financial.

Traders continue to position for price gains through options even as BTC trades listless below $100K.

Hash Ribbon signals miner capitulation, which tends to mark a local bottom in the bitcoin price.