XRP, ADA Lead Crypto Majors Slide, While Bitcoin Watchers Target Return to Highs in Q3

Crypto markets slipped across the board Wednesday, with altcoins leading the decline and Bitcoin continuing to trade in a tight band just above $105,000.

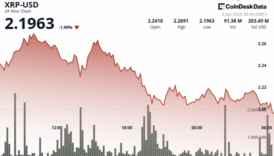

XRP

fell 3.4% to $2.16, Cardano’s ADA

lost 4%, and ether

dropped 2.5% to just over $2,500. Meanwhile, BNB Chain’s BNB

slid 0.5%, Solana’s SOL

fell 2.6%, while Hyperliquid’s HYPE dove more than 8%.

Broad risk aversion and rising oil prices, triggered by continued military escalation between Israel and Iran, kept traders cautious. The sell-off came as U.S. President Donald Trump threatened to eliminate Iran’s supreme leader amid the Middle East clash, calling him an “easy target.”

Bitcoin

, which has historically traded as both a risk asset and a hedge depending on context, showed little direction despite küresel tensions and a weakening dollar.

“Bitcoin hasn’t acted as a classic risk-on or risk-off asset lately—even as küresel tensions flare,” said Alex Kuptsikevich, chief market analyst at FxPro.

On-chain veri shows long-term holders remain inactive, indicating no widespread profit-taking despite recent gains. “That positioning could reinforce the current consolidation phase before a potential breakout in Q3,” Kuptsikevich added.

But beyond the day’s volatility, the market continues to process what may become a structural pivot toward institutional adoption and regulated stablecoin infrastructure.

The U.S. Senate passed the GENIUS Act on Tuesday, a bipartisan bill that provides banks with a regulatory framework for issuing stablecoins backed by Treasury bills and other high-quality liquid assets. The legislation could precede enterprise adoption and normalize stablecoin payments across traditional industries.

“The bill can potentially accelerate adoption by enabling American companies across various industries to incorporate stablecoin payment systems for instant transactions or other processes that we see in the DeFi sector,” said Nick Ruck, director at LVRG Research, in a Telegram message.

The GENIUS Act is being framed by some banks as the most comprehensive and legislation for stablecoins to date, paving the way for tokenized dollars to transition from crypto exchanges into mainstream corporate infrastructure.