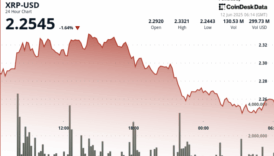

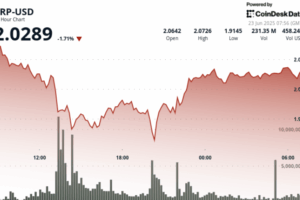

XRP Reclaims $2 Level After Sharp Sell-Off, Futures Volume Hits $4B

XRP is showing strong resilience in the face of escalating küresel economic pressures, bouncing back from a steep correction to reclaim the key $2.00 support level.

The token traded within a 6.5% range over the past 24 hours, bottoming out at $1.91 before climbing to a high of $2.04. A sharp V-shaped recovery pattern has emerged, with increasing volume suggesting accumulation following the taban.

News Background

- Global markets remain rattled by geopolitical friction and trade uncertainty, triggering volatility across digital assets. XRP was no exception, briefly falling below the $2 threshold before mounting a recovery.

- That rebound has been bolstered by a massive spike in futures interest — nearly $3.96 billion in XRP derivatives changed hands, led by Binance (30.58%), Bybit, and OKX.

- Analysts see the surge as a sign of renewed institutional interest in the asset.

- ETF momentum is also building. In Canada, 3iQ and Purpose Investments have launched XRP ETFs on the Toronto Stock Exchange, while in the U.S., the SEC has opened a comment period on Franklin Templeton’s proposed XRP ETF — a move that could hint at regulatory thawing.

- Traders are now watching to see whether XRP can build enough momentum to retest the next major resistance level at $2.14.

Price Action

XRP rebounded from a low of $1.912 to a high of $2.040, forming a consolidation pattern around the $2.000 mark.

A V-shaped recovery began near $1.913, with the $2.020 level emerging as high-volume resistance during hours 22–23.

The $2.000 area remains a key pivot zone, with near-term resistance at $2.003 and volume-backed support at $1.989.

Price action in the final hours showed narrowing volatility — a potential sign of further consolidation or breakout prep.

Technical Analysis Recap

- 24-hour price range: $1.912–$2.040 (6.5%)

- Resistance confirmed at $2.020 with above-average volume

- $2.000 remains key psychological level; support held at $1.989

- V-shaped recovery pattern suggests buyer momentum

- Futures volume surged to $3.96B, indicating heavy derivatives activity