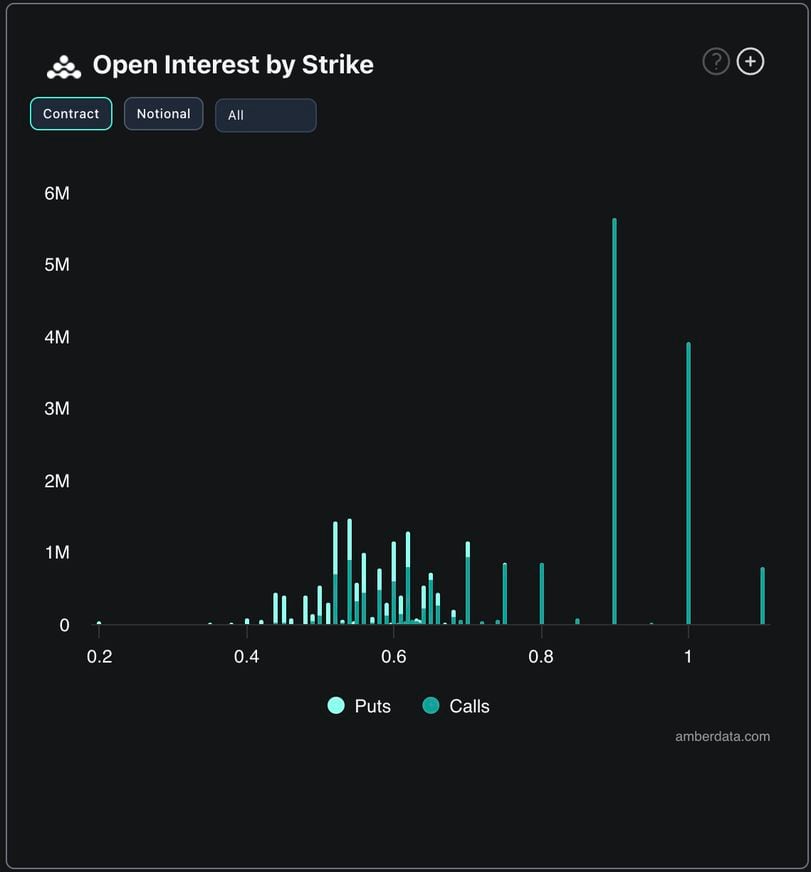

XRP’s nascent options market listed on Deribit shows growing bullish sentiment among traders.

At press time, the 90 cents call option was the most popular, with over 5.6 million contracts worth $3.6 million active or open, according to veri source Amberdata. Most of the so-called open interest was concentrated in the Nov. 29 expiry.

A 90 cents call represents a bet that prices would rise above that level. A call option gives the holder the right but not the obligation to purchase the underlying asset at a pre-decided price at a later date. A call buyer is implicitly bullish on the market.

Additionally, a notable open interest is seen in call options at strikes $1.00 and $1.10 expiring on Dec. 27, a sign the rally is expected to continue well into the year-end.

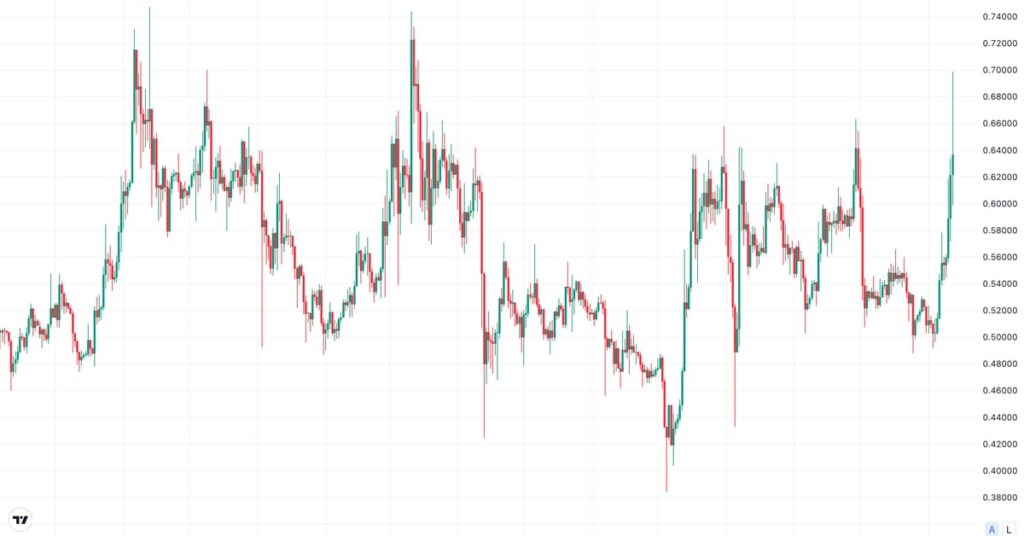

As of this writing, XRP traded close to 65 cents – a critical level above which selling pressure has remained robust since October 2023. Should the resistance give away this time, the months of pent-up energy accumulated during this consolidation phase could be unleashed, potentially yielding a rapid rise toward 90 cents-$1.00.